EIA & IEA Reports – What’s coming in 2019?

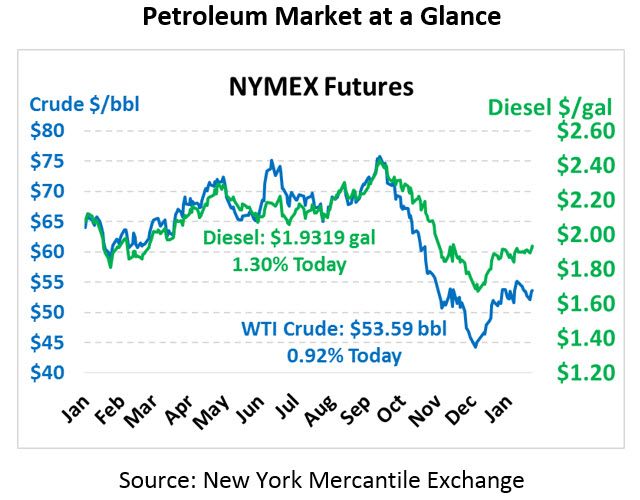

Oil prices are up slightly this morning, gaining positive traction as government shutdown risks diminish and oil stocks fall. Crude is currently trading at $53.59, up 49 cents since yesterday’s close.

Fuel prices are also seeing a boost this morning. Diesel prices, buoyed by a strong inventory draw, are trading at $1.9319, up 2.5 cents. Gasoline prices are $1.4379, up 1.1 cents.

With round 2 of the government shutdown looming on Friday, Congress appears to have reached a solution. Although the proposal delivers just 25% of the funding Trump was seeking for a border wall, both parties are jumping behind the agreement, which would extend government funding through September 30. Trump has expressed his dissatisfaction with the funding shortfall, but sources close the President have suggested he’d sign the deal anyways to avert a shutdown.

The API released their weekly inventory numbers, revealing a strongly bullish slant for inventories. Diesel stocks more than doubled their expected draws, and crude oil posted a surprise draw for the week. The EIA has the final word on inventories, though, so markets will be waiting until the 10:30 EIA report to see whether the API’s report was correct.

The EIA and IEA posted their updated monthly oil reports yesterday and today, providing a glimpse into trends coming this year. The big takeaway from the EIA’s report is that US production is quickly charging ahead, while global oil demand is declining – resulting in a net inventory build of 0.4 MMbpd throughout the year. The IEA made similar upward revisions to supply while cutting demand forecasts, but their highlights focused on Venezuela and the disruption to global oil supplies. While there’s ample crude quantity, there’s a crude quality issue caused by the loss of Venezuela’s heavy crude that will be harder to overcome.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.