Week in Review

After prices were bid up last week among Venezuela sanctions, markets reverted lower again on profit-taking and reduced economic growth prospects for this year. Oil prices have been fairly range-bound, so prices simply bounced off their Friday high to trade lower this week. While stocks have made a significant recovery since their November bear market, oil has struggled to break out of the $50-55 range.

Venezuela has remained dominant in headlines this week, with the focus this week on how American refiners will replace the lost supply of heavy sour crude. The US produces very light, sweet crudes, which typically trade at a premium to heavy sours, but recently that relationship has flipped in some areas. Canada is the nearest close substitute, but pipelines from Canada are already flowing at capacity, and this week a pipeline shutdown further limited exports. Some have begun exploring exports by rail to get Canadian crude south – a solution that’s usually cost-prohibitive, but recent economics have made it more favorable.

Yesterday’s report of weak economic growth in the EU reminded markets of how precarious the demand forecasts are for the year. There are a litany of possible economic headwinds this year – federal balance sheets tightening globally, US-China trade, Brexit and more. Any of these has the capability to shut in demand, keeping oil prices from rising higher.

Prices in Review

Crude oil began at $55.32, on the heels of strong gains last week. Crude trended generally lower throughout the week – falling on Tuesday, rising slightly on Wednesday, then bottoming out on Thursday. The EIA’s data helped provide midweek support, confirming the market’s expectations and contradicting the more bearish API news. But concerns that crude demand could fall outweighed the near-term trend, sending prices plummeting. Crude oil opened this morning at $52.59, a loss of $2.73 (-4.9%).

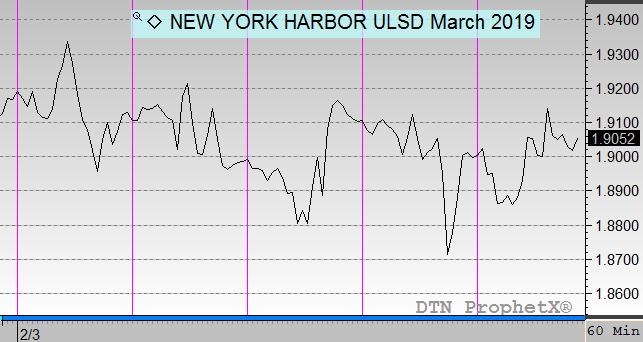

Diesel prices have been somewhat less negative, though they still appear on track to end in the negative. Diesel opened the week at $1.9122, sank lower midway through the week, then was lifted by a reported EIA inventory draw. Thursday’s losses failed to stick, leading Friday’s opening price of $1.9000 to be just 1.2 cents (-0.6%).

Gasoline prices have seen a good deal of volatility this week, opening at a strong $1.4351 after trading lower last week. Prices declined until the EIA’s report on Wednesday showed a stock draw below expectations. Like diesel, the Thursday price rout came with a rebound, but prices still closed lower. Gasoline prices opened at $1.4248 this morning, down 1 cent (-0.7%); however, it should be noted that prices have since been rising.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.