Week in Review

Oil trends this week brought crude prices marginally higher, though fuel prices have struggled to make progress. Leading the news this week has been turmoil in Venezuela, where the US imposed sanctions on the country’s leading oil company PDVSA. The US has now firmly aligned itself with the opposition leader after years of trepidation that sanctions would send an already unstable state into chaos.

Sanctions prevent the importation of Venezuelan crude oil, along with exports of American diluents (very light crude oil blends) that are mixed with Venezuelan crude to make it flow through pipelines more efficiently. Venezuela exports 500 kbpd of oil to the US, or roughly 3% of America’s daily crude requirement, so sanctions are expected to disproportionately impact US oil prices. Cutting Venezuela off from America’s supply of diluents is expected to prevent roughly 350 kbpd of oil from reaching the market at all, causing a global effect on prices.

Along with added risk premium in Venezuela, the Federal Reserve opted not to increase interest rates in this week’s meeting, taking a more dovish stance by noting they have the “luxury of patience.” Keeping interest rates steady is slightly supportive for oil prices; rising interest rates boost the US Dollar, causing oil prices to fall. However, the dovish stance also shows the Fed is concerned that economic growth may be slowing in the US. A slowdown in economic activity would cause fuel demand (and prices) to fall.

Record cold levels in the northern half of the country have put upward pressure on diesel prices. Cold weather leads to more heating oil demand, used to warm homes and businesses. On the flip side, though, temperatures have fallen so low that it’s forced consumers and commercial vehicles off the street in some areas, lowering demand. The two factors have largely cancelled each other out, leading markets to seek direction in other areas.

Prices in Review

Crude oil prices began the week strong, but quickly fell on Monday to weekly lows. Since then, though, prices have generally trended higher, fueled by Venezuela hype. Prices on Thursday even surpassed $55/bbl briefly before turning lower – the highest markets have traded since late November. Crude began the week at $53.56 and opened this morning at $54.01, a moderate gain of 45 cents (0.8%).

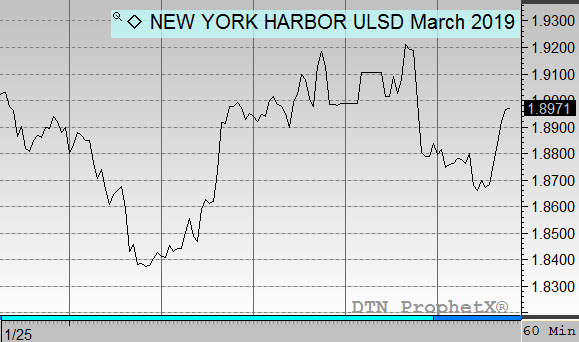

Diesel prices followed a pattern similar to crude, falling on Monday before rallying post-sanctions. Thursday saw an outsized bit of selling pressure for diesel, causing prices to close significantly below their opening price of the day. Diesel opened the week at $1.8874, trading higher for most of the week before opening this morning lower at $1.8845, a margin change of 0.3 cents.

Gasoline prices were almost completely unchanged from Monday’s opening price to that of today, but later trading may put this week solidly in the black. Prices opened Monday at $1.3857, and this morning prices opened at $1.3860. Lower refinery runs may cause gasoline inventories to begin inching lower, which would lift gasoline prices relative to crude.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.