Baby, It’s Cold Outside

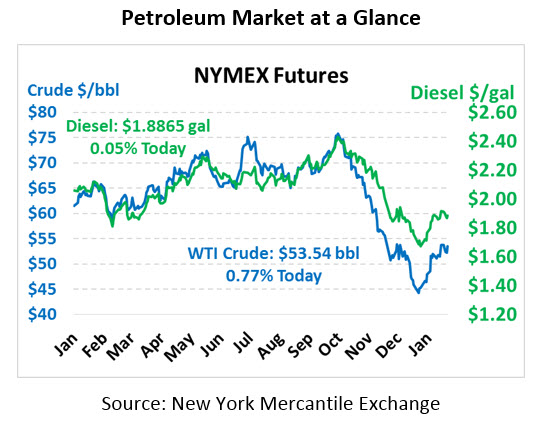

With the government finally back up and running (at least until Feb 15), you’d expect prices to rebound – but you’d be wrong. Further negative data from China is weighing heavily on markets this morning. Crude oil is trading at $51.58, down $2.11 (-3.9%) from Friday’s close.

Fuel prices are both seeing roughly 5-cent losses this morning as economic data spills over to fuel demand. Diesel prices are currently trading at $1.8404, down 2.7%. Gasoline prices are trading at $1.3368, down 3.8%.

China’s data is leading the news this morning, with industrial profits declining almost 2% compared to last year. China also reported importing 500 kbpd of oil from Iran, despite waivers allowing for just 360 kbpd of imports. Above-expected purchases means excess supplies from Iran are hitting the market, causing supply to outpace expectations.

Rig counts, reported on Friday, rose for the first time this year, as North America picked up 10 additional rigs. The fact that rig counts can rise even as crude prices remain well below their 2018 peaks shows that US production cannot be slowed by low prices. Markets fear an excess of production in the US could cause oversupply globally, keeping prices low.

Unless you’re living in the Deep South, you’ve probably noticed how cold it is outside. The weather channel shows temperatures plunging well into sub-zero in many parts of the country, and freezing temperatures extending as low as northern Texas. A low of -45⁰ F in Minnesota shattered daily records set in 1966. Cold weather is expected to continue through the week. From a fueling standpoint, cold weather means both supply and operational issues. Cold weather increases generator and heating oil demand, and also can cause gelling of diesel fuels. At such low temperatures, both kerosene and additives are needed to prevent gelling issues.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.