Bullish Statements Boost Prices

Mansfield is hosting a webinar at 1PM EST to review Q4 and provide a 2019 oil price outlook. If you’d like to hear more about the trends below, Click Here to register.

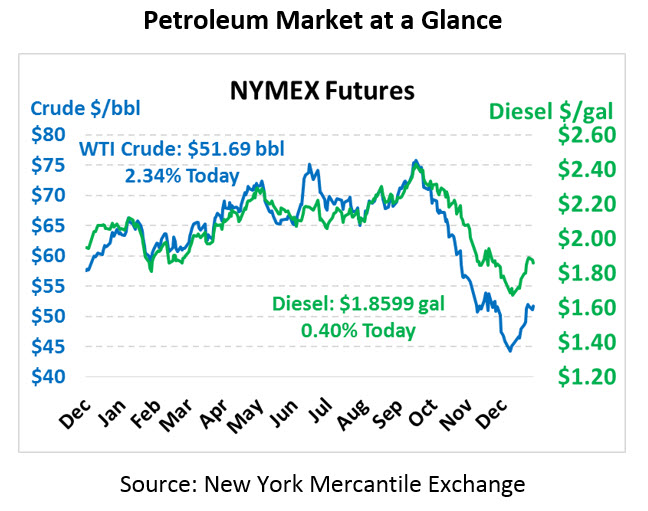

Oil prices are rallying strongly this morning after yesterday’s large losses. Yesterday’s $1/bbl losses were likely profit-taking after some hefty gains recently, and a wave of bullish news helped halt the decline. Crude oil is trading at $51.69, up $1.18 from Monday’s close.

Fuel prices are also moving higher this morning. Diesel prices are trading at $1.8599, up 0.7 cents from yesterday’s close. Gasoline prices are $1.3977, up 3.4 cents.

Yesterday brought a slew of supportive comments to push prices higher. In the US, the State Department indicated they do not plan to grant new waivers for purchases of Iranian oil. Back in November, the Trump administration granted waivers to 8 countries, who collectively made up 75% of Iran’s oil exports. No new waivers means global supplies will effectively be reduced, causing higher prices. In a similar vein, the US is reportedly once again considering sanctions on Venezuela, which might be targeted at their oil exports.

Outside the US, Saudi Arabia’s Energy Minister noted that the Kingdom would not rule out any production cut needed to balance oil prices in 2019. Saudi Arabia’s government budget requires crude oil prices at $80 to be balanced; any shortfall could force spending cuts and social unrest, something Saudi leadership would vehemently oppose.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.