Post-Christmas Rally Undoes Holiday Sell-Off

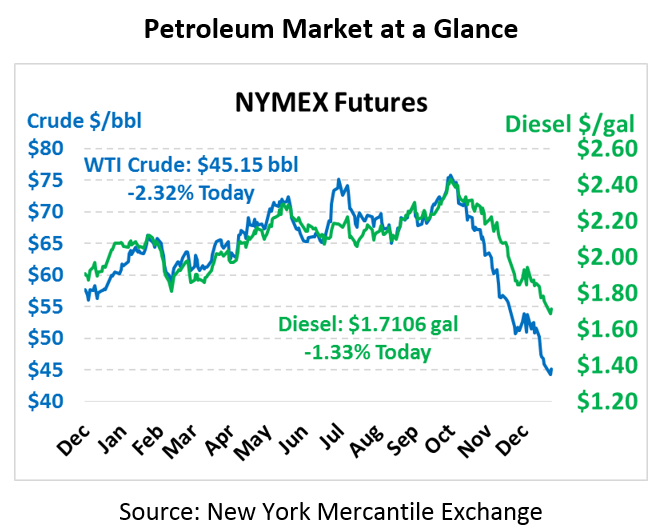

Markets rebounded from the holiday plunge, gaining over $3.50/bbl while the stock markets roared upwards as well. This morning, though, those gains are struggling to hold on. Crude is currently trading at $45.15, hovering near the $45/bbl level after shedding $1.07.

Fuel prices are also lower after hefty gains yesterday. Diesel prices gained 7 cents yesterday, while gasoline picked up 8 cents. This morning, diesel prices are trading at $1.7106, down 2.3 cents from yesterday’s close. Gasoline prices are $1.3230, a lighter loss of 0.7 cents.

Yesterday’s rally was in part a sympathetic reaction to the massive stock market gains – the Dow picked up over 1,000 points yesterday as traders temporarily forgot the US-China trade war and Fed rate hikes and instead looked around at the outstanding retail sales this holiday season and other strong economic indicators. It’s too early to call a bottom to the recent bear market, but yesterday’s rally proved that the bulls are still lurking in the market and can react quickly to send prices higher.

Adding to the bullishness was concerns over Venezuelan production. Venezuela’s production has been steadily declining all year, with further losses expected in the future. The military has taken over PDVSA, Venezuela’s state-owned energy company, and military leaders lack the industry acumen needed to turn around flagging production. Struggling with 1,000,000% inflation, PDVSA has reportedly lost nearly a quarter of its work force compared to 2016, and the company struggles to meet its supply commitments. While declining Venezuelan production is already baked into global supply forecasts, an acceleration in losses could tighten the market somewhat.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.