Week in Review

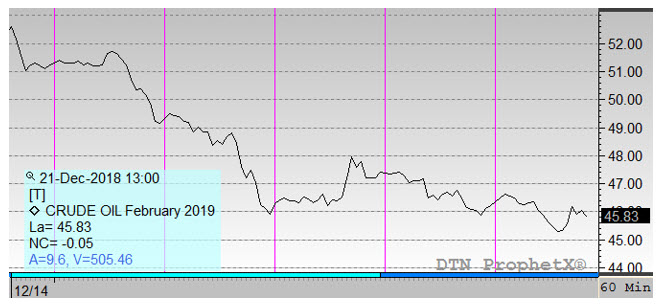

This week oil prices crossed a boundary few expected, with prices on Monday closing below $50, setting the tone for a rapid drop to $45. Many of the declines lately have shown a similar pattern – breech a key psychological barrier, then quickly fall to the next:

- October 17 – Prices drop below $70. Fell to $65 two weeks later.

- Nov 1 – Prices drop below $65. Fell to $60 a week later.

- Nov 12 – prices drop below $60. Fell to $55 the next day.

- Nov 20 – prices drop below $55. Fell to $50 in two days.

- Dec 17 – prices drop below $50. Fall to $46 the next day, $45 two days later.

Crude trading at $50/bbl is an arbitrary number – the difference between $49.99 and $50.01 is virtually nothing, but there’s psychological value. Many automated trading strategies use round numbers for simplicity – $45, $50, $55. When those levels are breached, they trigger significant market moves despite have no true fundamental driver. Since the $60/bbl level was breached in early November, purely technical plays have been driving the market lower.

Why does that matter? Very few analysts, agencies, or banks agree that $45/bbl oil is justified. While demand prospects are gloomy, inventories are far lower than the last time oil was at $45. OPEC has been moderating supply and appears to be on track to do the same in 2019. If it’s true that the recent bear market was caused by tech and not truth, then consumers should expect prices to rebound in the coming months back to $60/bbl crude (diesel ~$2.10).

Prices in Review

Crude began the week at $51.25, but quickly fell below the $50 threshold triggering a steep selloff the next day. Wednesday’s EIA data showed supportive data that helped prices rise a bit, but the bullish data was not enough to trigger a rally. Since then, prices have been hovering close to the $45 mark, with oil this morning opening at $46.25, a loss of $5 even (-9.8%).

Diesel prices also started the week off with a shot lower, falling from an opening price of $1.8452 to $1.82 on Monday, then sinking quickly to $1.75 the following day. Wednesday’s inventory report of a sizable stock draw gave prices a shot in the arm, but the effects were short-lived. This morning diesel prices opened at $1.7647, a loss of 8.1 cents (-4.4%).

Gasoline prices were once again firmly bearish this week. Beginning the weak at $1.4362, price saw consistent losses each day except Wednesday. This morning, gasoline prices opened at $1.3349, a drop of 10.1 cents (-7.1%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.