Hitting Where It Hurts – Saudis to Cut Exports to US

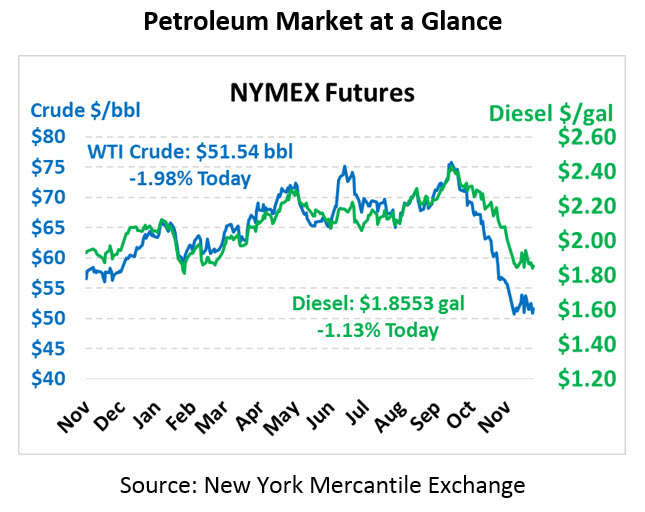

Yesterday brought oil prices back above $52, but given the recent $50-$53 holding pattern for WTI, markets aren’t expecting any breakouts this go-round. Although prices have shown little desire to breach the $50/bbl floor, they seem almost as hesitant to mount a significant rally. This morning crude is trading at $51.54, a drop of $1.04 (-2.0%).

Fuel prices are also in the red this morning. Yesterday saw gasoline prices surge by over 5 cents, though diesel prices gained just 2.5 cents. This morning, diesel prices are $1.8553, down 2.1 cents (-1.1%). Gasoline prices are at $1.4429, a steeper loss of 3.5 cents (-2.4%).

Yesterday’s rally was brought by Saudi Arabia’s warnings that Saudi exports to the US will be cut in 2019. Saudi Arabia will be shouldering a significant portion of the 1.2 MMbpd OPEC cuts, and to get a quick result they’re targeting US supplies. The US the largest consumer of fuel in the world, making it a useful proxy for global supply/demand balance. We also publish the most transparent data on supply and demand via the EIA’s weekly petroleum report. If Saudi Arabia can cause US inventories to drop, oil prices globally will respond by moving higher.

Yesterday the Chinese government reported the lowest industrial production in almost three years, signaling slow growth in the world’s second largest economy. The country’s retail sales also fell to a 15-year low. With US-China trade still a contentious issue, any signs of economic slowdown will put domestic pressure on the Chinese government to reach an agreement on trade. If the trade war continues and the Chinese economy continues slumping, expect fuel prices to decline; after all, a significant portion of global oil demand growth comes from emerging economies such as China.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.