IEA Reports More Bullish View of 2019

Markets are proving once again that any rally will be squashed by concerns about economic growth next year. After closing above $52 on Friday, crude prices hovered around $51 this week until today. This morning, crude is trading at $50.81, down 34 cents.

Fuel prices are mixed this morning, trading inversely to yesterday when diesel prices rose and gasoline fell. Diesel prices are trading at $1.8410 this morning, down a penny. Gasoline prices are $1.4258, up a meager 0.5 cents from yesterday.

The EIA’s weekly inventory report showed the API’s data to be wrong across the board – the strong crude draw was actually quite weak, gasoline stocks rose instead of falling, and diesel fell instead of building. Although the EIA’s report wasn’t necessarily bearish, the contradiction of the API’s data disappointed markets. The data also showed a sharp downward correction in exports from last week’s anomalously high 3.1 MMbpd threshold.

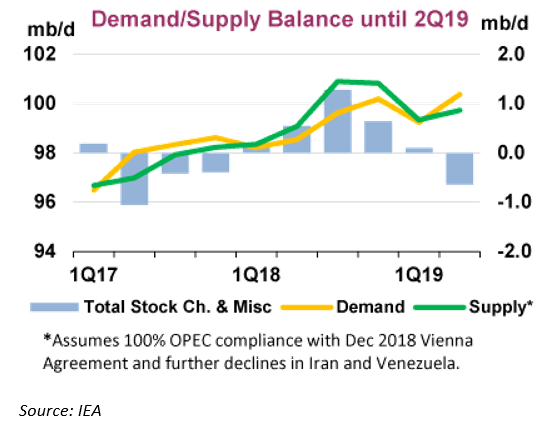

The IEA released their monthly oil analysis this morning, revealing a more bullish outlook than the EIA produced earlier this week. While the EIA shows supplies in a net build for the first half of 2019, the IEA’s data suggests a balanced market in Q1 giving way to tightness in Q2. Outside revisions based on OPEC’s decision, though, the IEA’s report was largely unchanged from November’s report.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.