After OPEC Cuts, Markets Uncertain

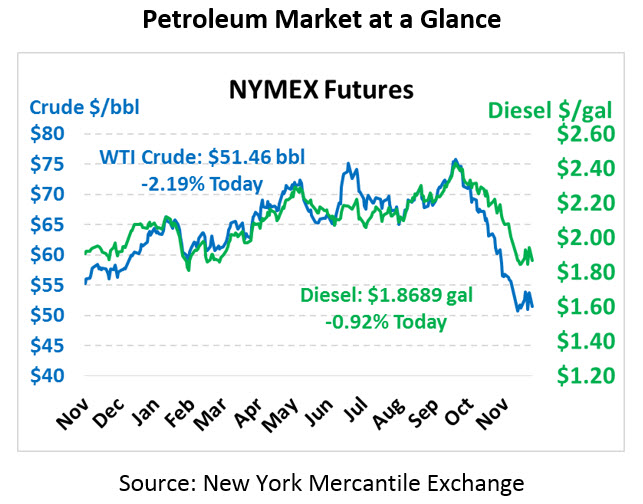

After OPEC appeased markets on Friday with a 1.2 MMbpd production cut, traders are left questioning whether it will be enough. Today’s losses signal some uncertainty among traders. Crude is currently trading at $51.46, down $1.15 from Friday’s close.

Fuel prices are taking a smaller hit this morning, though still remain negative. Diesel prices are trading at $1.8689, down 1.7 cents from Friday’s close. Gasoline prices are $1.4451, down 4.1 cents.

OPEC’s cuts are certainly bullish for prices, but exactly how much they’ll affect markets – and when – is yet to be seen. While OPEC agreed to 800 kbpd in cuts, along with 400 kbpd from non-OPEC members, there was no country-specific allocations of those cuts. Undoubtedly Saudi Arabia and Russia will take on the lion-share of the cuts, but other nations have not clearly shown their support for the cuts. The cuts also won’t take place until January, so in the meantime inventories are expected to continue rising. In other OPEC news, instability in Libya caused a shutdown of the 315 kbpd El Sharara field; Libyan officials have yet to provide details on the scope or expected length of the shutdown.

This morning’s decline comes along with continued bearish pressure in the stock market. The Down Jones Industrial Average has erased most of this year’s gains, currently at its lowest point since May. Regardless of supply cuts, markets worry that demand growth in 2019 will be tepid, causing inventories to swell.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.