Week in Review

While markets at times go long-stretches without any fundamental changes in the market, this week has been non-stop. The week began with several major announcements capturing the attention of traders:

- The US and China agreed to more intensive trade negotiations to resolve the trade war.

- Saudi Arabia and Russia agreed, in principle, to the need to cut oil output

- Canada announced a 300 kbpd cut in Alberta crude output.

That last announcement is more eventful than it sounds – in conjunction with the output cut, the Canadian government will be investing in more crude pipelines to move the product out of Western Canada. Western Canada Select (WCS) crude, which trades as a diff to WTI crude, rose from trading $45 below WTI to just $20 below yesterday. That means a barrel of Canadian crude sold for just $10/bbl in November, but now is trading for almost $30/bbl!

The increase in Canadian prices will have an impact on US consumers. Chicago refineries have been buying extremely cheap $10 Canadian crude, refining it into gasoline and diesel, and selling it cheaper than Gulf Coast or Northeast refiners who pay $50 or more for crude. With Canadian products now more expensive, Chicago refineries will have less economic benefits from producing fuel. After sustaining extremely high utilization rates this past year, we may see less output in 2019, putting more pressure on fuel supplies and pushing prices higher, particularly in the Midwest.

OPEC’s meeting later in the week brought significant volatility, causing prices to turn lower Thursday as prospects for a deal seemed dim. But a Friday morning announcement that OPEC and Non-OPEC members will cut a combined 1.2 MMbpd is causing an oil complex rally, bringing prices up nearly 5% in one day.

Prices in Review

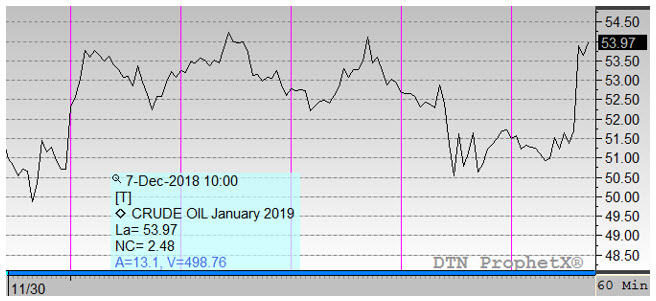

WTI crude oil opened the week at $52.45, slightly higher than previous weeks where oil had been trading as low as $50. The fundamental market data reports had little influence on oil prices, with OPEC and the G20 meeting dominating the price narrative. Prices fell steadily throughout the week amid fears that OPEC would not reach a deal, but an announced 1.2 MMbpd cut for 2018 caused prices to soar Friday after opening lower. WTI opened Friday at just $51.76, an apparent loss but one erased by this morning’s strong trading.

Unlike crude oil, this morning’s gains in fuel prices were not necessary to keep weekly prices in the black. Diesel prices opened on Monday at $1.8425, quickly rising higher to end with a 4-cent gain that week. Tuesday brought another strong day of trading, though Wednesday and Thursday were weaker. Diesel opened this morning a $1.8667, a gain of 2.4 cents before including this morning’s 8 cent gains.

Gasoline prices also opened at a low level on Monday but managed to rise higher. Gasoline prices on Monday opened at $1.4126, rising higher and see-sawing until Thursday, which saw prices drop decisively lower. Still, gasoline opened Friday at $1.4410, nearly 3-cent gains for the week, and Friday’s morning and afternoon trading will likely bring even more gains.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.