4 Major Takeaways from G20 Meeting

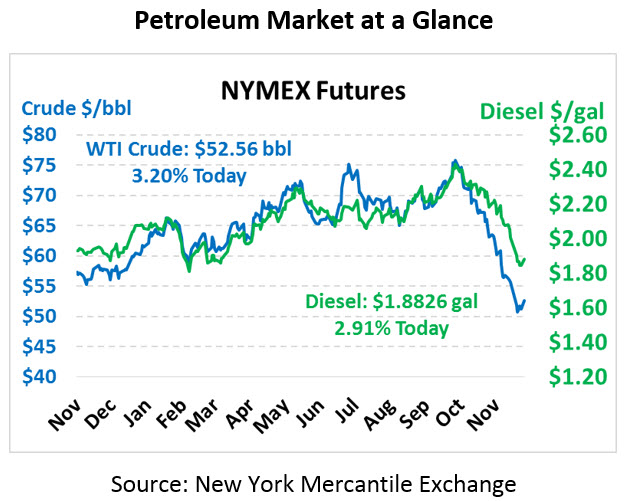

It’s dangerous to try calling a bottom in oil prices, but after this weekend’s strongly bullish set of statements, today’s rally certainly feels like the beginning of an uptrend. Crude oil is currently trading at $52.56, up $1.63 (3.2%) – if that gain holds, it will be the largest gain since Oct 1, just before prices hit their 2018 peak.

Fuel prices are also firmly in the black this morning. Diesel prices are trading at $1.8826, a strong gain of 5.2 cents (2.9%) this morning. Gasoline prices are $1.4300, up 2.8 cents (2.0%) from Friday’s close.

Over the weekend, Qatar announced plans to withdraw from OPEC on Jan 1 to focus on their natural gas production. Although the country claims the decision is not political, it does come after long-held tension between Qatar and Saudi Arabia. Qatar is one of the smallest oil producers in OPEC, but is a global leader in LNG exports; however, their decision to focus on natural gas does not mean they’re ignoring oil output. Qatar did note they would attend the OPEC meeting this week and abide by its output decisions.

The decision in itself is not necessarily significant for global oil prices, but Qatar’s withdrawal does create a precedent for other countries to follow. OPEC is heavily dominated by Saudi Arabia, the largest producer among OPEC nations. Increasingly, Russia and the US have been influencing the organization as well, further removing influence from smaller countries. As smaller members grow dissatisfied by OPEC’s decisions, they may move to join Qatar as independent producers, reducing the organization’s ability to influence global oil prices.

G20 Party

The G20 brought a slew of news causing today’s market rally. Bringing together the leaders of the 20 largest economies in the world, major announcements are expected. Given stagnant results at other international conferences this year including APEC in November, the NATO Summit in July, and the G7 in June, it’s refreshing to have a meeting end with progress. Among the meetings most important takeaways were:

- Official Signing of New NAFTA. On Friday, the US, Mexico, and Canada signed a new trade agreement, formally called the US-Mexico-Canada Agreement (USMCA). With a new deal formalized, Trump announced his intentions to withdraw from the old North Atlantic Free Trade Agreement (NAFTA), forcing Congress to opt for the newly negotiated deal. The deals are quite similar, but USMCA will shift more auto manufacturing from Mexico to the US and allow more dairy exports from the US to Canada. USMCA also paves the way for the US to lift its steel tariffs it placed on Canada back in May.

- US-China Trade Talks. Trump and Chinese President Xi sat down for dinner to discuss escalating trade disputes, and both parties walked away with a positive disposition. Trump was planning to raise tariffs from 10% to 25% on the goods already affected by the trade war, but agreed to a 90-day extension on tariff hikes to allow the countries to hash out their trade disputes. The extension doesn’t de-escalate the difficult trade relationship, but it does stop the escalation for now and provides some positive footing for future agreements.

- Khashoggi Killing Still a Hot Political Potato. After the international community condemned Saudi Arabia for the murder of Washington Post journalist Khashoggi, countries showed mixed opinions on Saudi leader MbS. Putin gave Khashoggi a high-five, but both the US and Argentina cancelled meetings with the Saudi leader. Canada, France, and UK ministers all made sideline comments on the killing, with Canada mentioning it during the G20. President Trump has provided political cover to the Saudis, saying there’s no conclusive evidence the Saudi regime had knowledge of the attacks. With no clear political follow-through for any of the condemnation of Saudi Arabia, it appears America’s political cover is working and that countries are not pursuing stronger action against the Saudi kingdom.

- Russia and Saudis Agree to Cuts. Russian President Putin and Saudi Crown Prince Mohammed bin Salman (often referred to as MbS) met on the sidelines of the G20 to discuss oil policies, and agreed that the OPEC+ group should continue balancing markets in 2019. The two countries want to support market stability, and will help guide the OPEC meeting quickly approaching this week. Still, Saudi Arabia is beholden to the US after the Khashoggi incident, and may feel pressure to keep 2019 output high.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.