Oil at $65 – Last Cheap Stop on the Bullish Advance?

Markets are thankful to be out of October – a month that generally brings poor results and seasonal weakness (think 1989’s Black Friday, or 1929’s Black Tuesday). Although there’s no particular reason for the bearishness, October tends to bring poor financial results. As we shared yesterday, the “Halloween Effect” shows that prices often fall between May and Oct 31, then rise from Nov 1 to April. Having brushed off October’s bearish trend, the stock market is trading higher this morning and the dollar is falling, both providing support to oil prices.

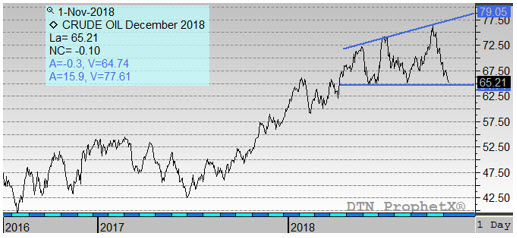

As we’ve mentioned several times recently, this is the third time prices have risen upwards before reverting back to roughly $65. Whether that floor will hold or not is very important to traders – they’ll be testing this level to see whether the bulls can pull prices upwards or whether the bears keep prices lower.

This price threshold presents an opportunity for consumers to consider locking in a fuel price for their budget year. When you’re driving down a country lane and you pass a lonely gas station, you ask yourself two questions – Is this the last pit stop for a while, and am I at risk if I don’t stop?

Is this the last stop?

Now is a good time to evaluate asymmetric risk in the market. As we look ahead to 2019, which price level seems more likely, above $80 or sub-$60? Either is possible, but not equally probable. Oil markets have been rising steadily since 2016, with some small slowdowns but no definitive breaks from the upward trend. While this $65-$75 range has slowed the upward momentum, we aren’t necessarily reversing.

OPEC has shown heavy support for keeping Brent crude in the $70-$80 range, meaning there are active market forces preventing prices from falling much lower.

But what prevents an upward breakout? US production, thought to be the new “swing producer” for the market, cannot get to market quick enough due to pipeline constraints. Iran and Venezuelan production will be offline for the foreseeable future as well, leaving global suppliers with no margin for error. A small uptick in demand or a surprise supply outage could easily send prices much higher.

All factors considered – if prices continue falling from here, they’ll perhaps fall as low as $60 (meaning diesel prices roughly 10 cents lower) before OPEC cuts output to bring prices higher again. If prices continue rising from here, there’s no ceiling – prices could easily rise to $80 or higher (meaning 40 cents or more in added diesel prices).

With 10 cents to lose and 40 cents to gain – right now appears an ideal time to consider locking in a fuel price.

Am I at risk if I don’t stop?

That’s a question only you can answer. Many fuel consumers can pass on higher prices to their consumers, in which case you’re not at risk. Others, especially private fleets or project-based crews, cannot recoup higher prices. Your budget may be based on an index, or may be a flat dollar amount. If diesel prices rise 40 or 50 cents over the next few months, how does that impact your budget and your buying metrics?

Mansfield has risk management experts who can help you answer these critical question, and provide feedback before market prices get away from you. It never hurts to be more informed on ways to protect your budget.

Click Here to learn more about price risk management or request a free fuel risk assessment.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.