Week in Review

After climbing just shy of multi-year highs early in the week, oil prices are firmly in the red for the week after weakening equity markets shattered confidence in global demand prospects. High oil prices and a strengthening US dollar have put a double whammy on developing nations – not only are energy costs going up, all imports are becoming relatively more expensive. Across-the-board expense increases are stifling demand, reducing economic forecasts for 2019.

Adding to the economic malaise is on-going tension between the US and China, as the countries escalate trade war threats. Analysts currently forecast a 2% GDP loss in China in 2019 as a result of the trade war, with detriment also coming to the US economy.

All of these economic threats are weighing heavily on oil markets, who are looking to equity markets as an indicator of declining demand. Although Iran and Venezuela may be producing less supply to meet demand, the call for that supply has fallen as well. While prices remain in striking distance of setting new multi-year highs, the bullish sentiment pushing prices higher at all costs appears to be slowing.

Oil Price Review

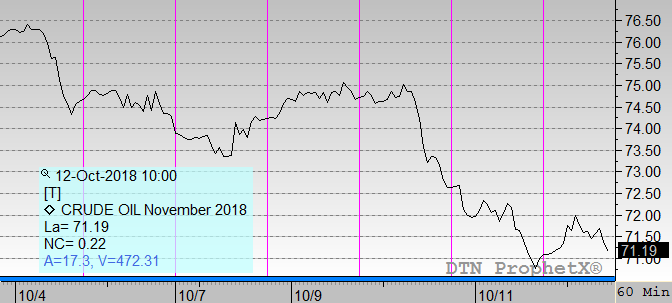

Crude oil prices began the week at $74.40, climbing as high as $75 on Tuesday and Wednesday before beginning to turn lower. On Wednesday prices turned steeply lower as equity markets suffered severe losses, and Thursday extended the losses. This morning, crude oil opened at just $70.99, a loss of $3.41 (-4.6%) for the week.

Diesel prices also took a heavy hit, falling from almost $2.43 to 10 cents below that level. Diesel began the week at $2.3955, climbing for a couple days before turning lower. This morning, diesel prices opened at $2.3345, a loss of 6.1 cents (-2.5%).

Gasoline prices also weakened this week, though – unlike crude and diesel – gasoline was a long ways off from multi-year highs. Gasoline prices began the week at $2.0876, climbing to nearly $2.10 on Tuesday before reverting lower. This morning gasoline prices opened at $1.9340, a huge loss of 15.4 cents (-7.4%).

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.