NAFTA is dead. Long Live NAFTA!

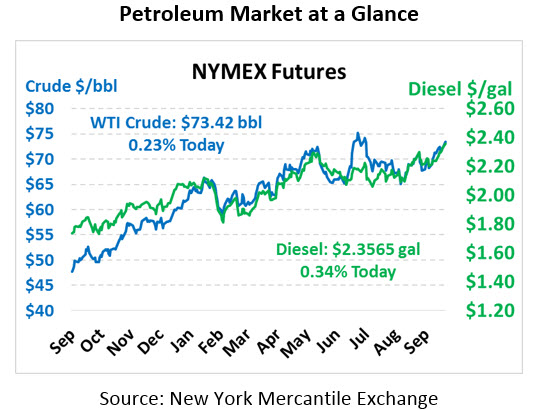

Oil is trading flat following reports of a new trade deal to replace NAFTA, despite a number of other bearish factors creeping in on the market. Prices surged higher late Friday morning without a clear catalyst, though market sentiment suggests the rally was related to fears of Iran sanctions. This morning, WTI crude is trading at $73.42, a gain of 17 cents.

Fuel prices rolled over to a new prompt month on Friday (from trading October prices to November prices) which caused gasoline prices to fall back a bit, though diesel prices remain strong. Gaining 3 cents on Friday, diesel prices are currently trading at $2.3565, a gain of 0.8 cents since Friday’s close. Gasoline prices were up two cents on Friday, but rolling from October contracts to November caused the market to shed most of those gains. This morning, gasoline is trading at $2.0865, up 0.1 cents.

Markets received a boost over the weekend from the passage of a trade agreement between the US, Mexico and Canada to replace NAFTA. The new agreement, called USMCA, looks quite similar to the old agreement, with just a few tweaks. The new policy grants US dairy producers access to a small portion of Canada’s $16 billion dairy market, and requires that more automobile parts be created in areas paying above $16/hr. (i.e., not in Mexico). Overall, all three countries have expressed satisfaction with the deal, and it sets the stage for US trade negotiations with the EU and ultimately could create momentum for a US-China trade deal.

Along with the new trade agreement, Iran sanctions remain one of the most influential components of oil prices, causing prices to continue ramping up despite a number of bearish factors creeping into the market.

- US Dollar Strength. While the US-Mexico-Canada Agreement will boost economic activity and therefore oil demand, it is also strengthening the US dollar. The dollar and oil prices trade inversely to each other because all oil prices are priced in dollars (meaning a strong dollar makes oil relatively more expensive internationally.) Along with weakening growth prospects in emerging economies, the dollar has risen to its highest point since early September, putting downward pressure on oil prices.

- EU-Iran Trade Vehicle. The EU is crafting a loophole mechanism to allow member countries to continue purchasing Iranian oil. The special purpose vehicle would allow European countries to pay in currencies other than US dollars, circumventing US sanctions. Companies trading with Iran would still be subject to the economic repercussions of secondary sanctions from the US, but EU courts would protect them at a legal level. Whether the special vehicle will be effective in facilitating trade with Iran is yet to be seen.

- Russian Oil Production. In September, Russian oil production reached its highest level since the disbandment of the USSR – pumping out roughly 11.3 MMbpd. While OPEC has not committed to raising production, Russia has certainly stepped up output, alleviating some of the supply tightness in the area.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.