Refinery Maintenance Season Underway

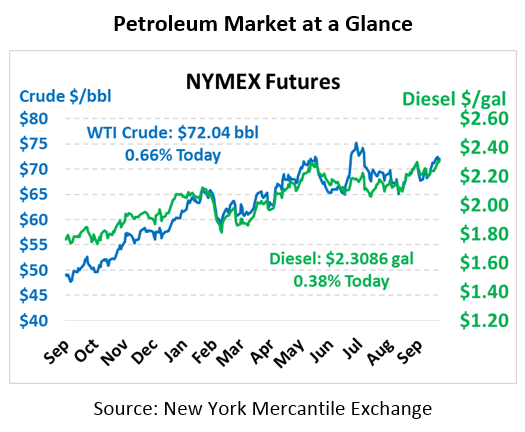

After mild losses yesterday, oil prices are heading higher this morning as markets continue worrying about Iran sanctions. Crude is currently trading at $72.04, up 47 cents.

Fuel prices are also heading higher this morning. Diesel prices are trading near multi-year highs at $2.3086 after picking up 0.9 cents. Gasoline prices are $2.0632, up 0.5 cents.

Markets are getting antsy looking towards Iran sanctions as we approach the November 1 effective date. Yesterday, Energy Secretary Perry announced the US would not use the Strategic Petroleum Reserve to offset lost supply, removing one possible source of relief. Markets are also speculating that India’s imports from Iran could drop to zero by November, though that won’t be verifiable until late October.

EIA Data

Yesterday brought a slightly bearish EIA report, though somewhat less so than the API’s data. While markets were expecting crude stocks to fall slightly last week, the EIA showed a moderate crude build of 1.8 million barrels. Gasoline also showed a build, while diesel posted a surprise draw. Cushing, OK, the delivery point for WTI crude, saw a half million barrel build as well, which is bearish for prices.

Fall maintenance season for refineries appears to be hitting its stride. Refinery utilization fell 5% to 90.4% this past week, which a large portion of that occurring in PADD 2 (Chicago/Midwest region). Today only the West Coast has utilization above 95%, all other regions have seen declining refinery activity.

This article is part of Alerts

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.