Refinery Downtimes to Bring Local Price Fluctuations

Following a bullish EIA report that included a Cushing inventory draw, declining crude and gasoline stocks, and a notable gas draw in PADD 1C where Florence hit, WTI crude prices closed above $71/bbl – the highest level since early July. This morning, prices are taking a breather amid profit taking by traders. WTI crude is trading at $71.25 currently, just pennies higher than yesterday’s closing price.

Fuel prices also rose yesterday, though with less gusto than crude. This morning both diesel and gasoline are in the red. Diesel prices are $2.2376, trading .09 cents below yesterday’s close. Gasoline prices are $2.0177, down 0.3 cents.

Yesterday’s EIA report was certainly the talk of the trade yesterday, particularly following Hurricane Florence’s disruption of East Coast gasoline and diesel demand. Florence caused several southeastern ports to close down temporarily, cutting off fuel imports and further contributing to the inventory draws.

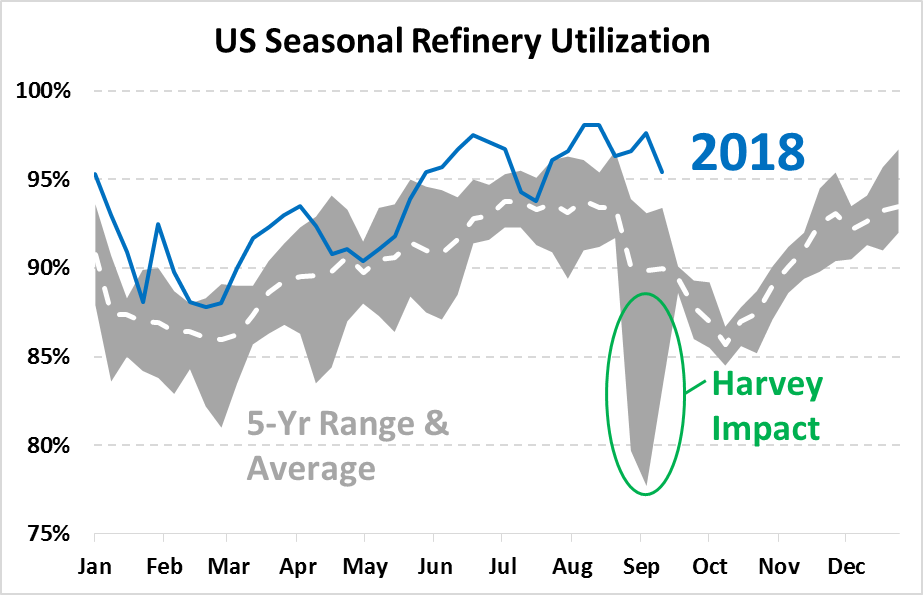

At the same time, refinery utilization was down across the US, falling from 97.6% to just 95.4%. While refinery production is still historically high for this time of year, it appears refineries are finally going down in preparation for the winter. Refiners often go offline in September and October to prepare for winter needs, such as optimizing to produce more diesel and less gasoline. Typically gasoline demand declines during the winter while diesel demand rises due to heating oil needs.

While there is sufficient supply available to meet demand in most areas, the decline in output could put some pressure on prices. For consumers, this trend is often seen most acutely in the Midwest, where agricultural harvest season (high diesel demand) meets refinery maintenance (low supply) and causes very high seasonal prices. The chart below shows Chicago diesel basis, the difference between the NYMEX diesel price and regional Midwest diesel prices. Currently, Midwest prices are just a penny above NYMEX prices, but in years past that premium has surged to 30 cents or even 50 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.