Prices Fizzle Out after EIA Data

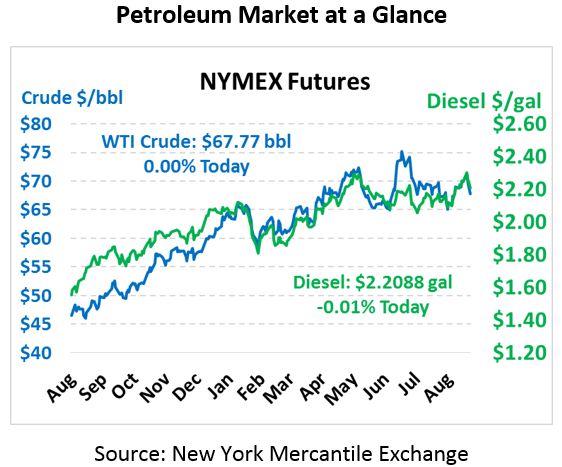

The oil complex is trading mostly flat this morning and is set to end the week lower. Crude fell to two-week lows yesterday, losing 87 cents as the market processed an overall bearish EIA report. Although crude saw a large inventory draw, both products and Cushing stocks built, giving the market a more bearish sentiment. Today, prices saw some early morning gains, but have since fallen back to yesterday’s close. Crude is trading at $67.77 currently.

Fuel prices are tracking crude closely this morning, making little movement in any direction. After the EIA reported large builds in both products, gasoline lost over a penny and diesel fell by 2 cents. This morning, diesel is trading flat at $2.2088 and gasoline at $1.9566, a small half-cent gain.

The EIA’s data showed that the API report was directionally correct, but the size of the draws and builds were off. Crude had a steep draw of 4.3 million barrels, but was outweighed by significant gains in gasoline and diesel stocks.

The draw in diesel stocks was somewhat surprising given a number of factors that ought to have caused a build. U.S. crude oil production was 11 million barrels per day, the fifth week this summer that production has hit this record level and the third week in a row. Additionally, crude imports rose by 200 kbpd, and exports were down 200 kbpd, causing a net 400 kbpd (2.8 million barrels total) in excess supply this week relative to last week. Despite those factors, an uptick in refinery utilization helped to deplete crude stocks this week.

Week in Review

As is often the case the week after Labor Day, oil prices declined during the short four-session week. Labor Day marks an end of summer gasoline demand season – the leaves are changing, temperatures are falling, and kids are heading back to school. Of course, the end of gasoline’s reign marks the beginning of diesel’s growth – lower temperatures cause a bump in heating oil demand each year.

Oil prices are trending slightly higher this morning, but the question is: will it be enough to reverse a week of losses? Markets have gone through a cycle of slowly climbing above $70, only to fall rapidly back down to the $65-$67 level. This week saw that trend continue as crude oil hit a low yesterday of $67.00. Some analysts have noted that prices will likely stay in this belt (absent a supply shock or economic disruption causing a surprise break) until November, when the US will officially impose sanctions on Iran’s oil supplies.

Markets continued watching America’s sanctions on Iran unfold this week – while China has already agreed not to increase purchases of Iranian oil, India (Iran’s second largest export partner) has been on the fence. The US and India have been in “detailed” negotiations this week, but the American stance is that our allies should import zero Iranian oil. Currently, it looks like India will follow China’s lead of continuing purchases of Iranian oil while not throwing the lifeline of additional purchases.

As we look to the months ahead, a good indication of the impact of Iranian outages will be OPEC production stats. Since Iran is a member of the organization, outages will count against OPEC’s total production. But other nations – including Saudi Arabia and Iraq – have pledged to fill the gap, so net changes in OPEC’s production will show whether other countries are truly replacing Iran’s supply. Last month OPEC production was up by 400 kbpd, thanks to Libya restoring production in some fields.

Prices in Review

After the holiday weekend, crude began the week with a bang, making significant gains on Tuesday. The markets fear of tropical storm Gordon drove crude prices to reach their weekly high of $71.40. However, after the storm made landfall as a non-event, the market sold off and prices quickly declined. This morning, prices opened at $67.88 bringing the week to a $2 loss if the market does not recover.

Like crude, diesel prices made headway on Tuesday, reaching a weekly high of $2.3093, before losing ground the rest of the week. Prices opened at $2.2091 this morning, a loss of over 3 cents. Diesel is set to end the week in the red.

Gasoline saw similar price action to crude and diesel and was the biggest loser for the week. Summer driving season has come to an end, so prices will likely begin to weaken as demand decreases. Gasoline has lost over 4 cents and is on track to end the week lower.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.