As Gordon Subsides, Markets Monitor Coming Storms

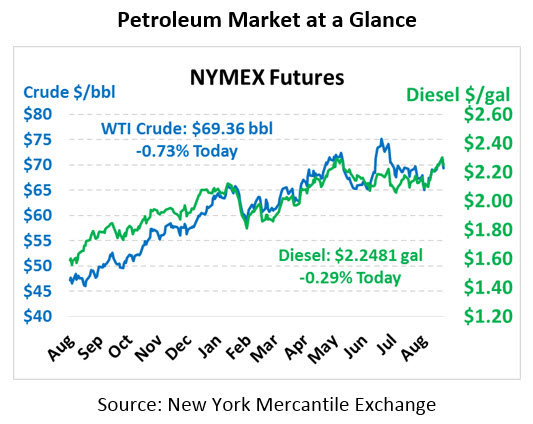

If you blinked, you may have missed yesterday’s hurricane-driven rally, which saw prices increase $1.50 before plummeting back down to its opening price. This morning, prices are net lower, as traders bought Hurricane Gordon’s approach and sold its landfall. Crude oil is trading at $69.36 this morning, down 51 cents since yesterday.

Fuel prices are following crude lower as the market awaits a delayed API inventory report this evening. Diesel prices managed to hold onto a moderate gain of 1.3 cents yesterday – much lower than the 6.5 cent gains achieved at the day’s peak. Gasoline, on the other hand, ended yesterday slightly in the red. This morning, diesel prices are trading at $2.2481, a loss of 0.7 cents. Gasoline prices are down to $1.9765, declining 1.8 cents.

Although much of the trade’s attention has been on Tropical Storm Gordon, international politics continue to play a part in driving prices. Faced with some of the highest fuel prices in the nation’s history, Indian officials indicated they will allow refineries to continue using Iranian crude oil, giving Iran another lifeline in the face of severe sanctions from the US. Now both China and India, Iran’s two largest crude export destinations, will continue accepting Iran’s crude. More details on India’s strategy on oil purchases are expected later this week.

Despite early reductions in Iran’s output, OPEC production increased in August by almost half a million barrels per day, largely driven by restored production in Libya. Still, the organization expects 100 MMbpd global oil demand to come sooner than expected, so the organization continues to expect prices to remain high. Saudi Arabia is targeting oil prices between $70 and $80, and with Brent crude trading above $77 this morning, they appear to be on track.

Tropical Storm Gordon Update – Code Green

Gordon made landfall last night as a Tropical Storm around midnight at the Mississippi-Alabama border, never achieving hurricane status. The system brought about 4 inches of rain in some areas and winds of 70 mph at its peak, causing power outages in Mobile, Alabama. Gordon, which has weakened to a Tropical Depression will continue weakening, will bring heavy rains throughout the South.

Fueling impacts were minimal following Gordon. Mansfield has gone off Orange Alert as terminals are all online and carriers are reporting normal freight capacity and safe conditions for deliveries. No refineries reported any outages or reduced operations, keeping the impact on fuel prices minimal during this event.

Attention now turns to Hurricane Florence, which strengthened to a Category 3 storm this morning – the first major hurricane of the season. Current forecasts show the storm strengthening further due to wind shear, but its trajectory is still unknown. Most models show the storm spinning northeast into the Atlantic, though it remains possible the storm could continue straight towards the US. Mansfield is monitoring the storm and will keep customers updated on its path.

Two more tropical waves are making their way through the Atlantic at the moment. The first storm, Invest 92, has a 90% chance of developing into a Tropical Storm by next week, at which point it would be named Tropical Storm Helene. Although it’s too early to accurately forecast its path, early models show potential paths tracking through the Caribbean or possibly as far north as South Carolina. The other storm has just a 30% chance of developing in the near-term, though later next week it could develop further.

This article is part of Alerts

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.