Iran Exports Decline Boosting Prices

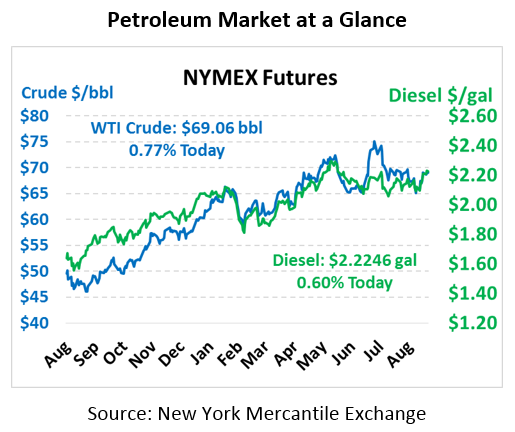

Oil prices are higher this morning as the market’s focus shifts to declining Iranian exports. Crude traded over $69 during yesterday’s session before retracting all of those gains and closing the day 40 cents lower. This morning, crude is making some upward movement, gaining 53 cents to trade at $69.06.

Fuel prices have also made some gains this morning following a day of losses. Diesel and gasoline both lost around a penny during yesterday’s trading session. Products have turned around this morning with diesel picking up 1.3 cents to trade at $2.2246 and gasoline up half a cent at $2.0835.

The API report was bearish for markets yesterday. Crude built by 0.4 MMbbls, contradicting the market’s expectation of a small draw. Gasoline and diesel both built, bringing products to a net build of 1.82 MMbbls for the week. The EIA report coming out later this morning will likely set the trading tone for the remainder of the week.

This week, the market is being driven by a combination of political headlines and global supply. Iran’s exports fell to 2.03 MMbpd for the month of August, down drastically from April’s 3.09 MMbpd in exports. The reduction in exports indicates Iran’s usual buyers are beginning to comply with Washington’s attempt to eliminate Iranian crude exports in anticipation of the November 4th U.S. sanctions implementation. Fatih Birol, Executive Director of the IEA, warned yesterday that global supply could likely tighten going into the end of the year amid strong demand and uncertainty in producing nations, namely Venezuela. Tightening global supply would likely result in a wider Brent-WTI spread, incentivizing U.S. producers to increase exports, taking additional product from the U.S. and giving prices a boost.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.