Iran Confronts Saudi Arabia on Increased Production

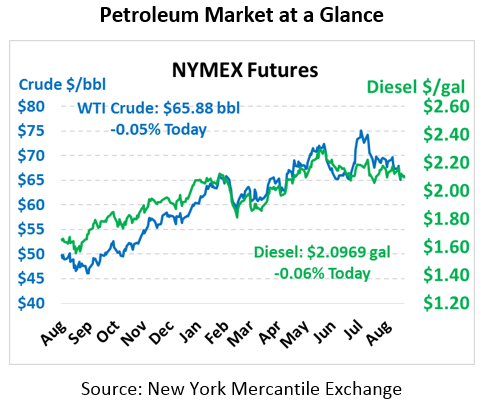

Oil markets are trending flat to slightly lower this morning following Friday’s small rally. Although Friday saw some upward price movement, the gains were not enough to keep crude in the black for the week. Market fear over slowing economic growth due to sanctions and tariffs and a surprise build in U.S. inventories gave oil their third consecutive weekly drop. This morning, crude prices are trading at $65.88, a loss of 3 cents from Friday’s close.

Fuel prices are yet again moving in opposite directions this morning. Both products ended the week in the red on Friday with gasoline being the biggest loser, showing some end-of-summer weakness. However, the story has changed this morning as gasoline is moving higher and diesel is trading slightly lower. Diesel prices are trading at $2.0969, down 13 points from Friday’s close. Due to some refiner issues in the Gulf Coast, gasoline prices have gained 73 points to trade at $1.9882.

In International news, Iran is attempting to rally support from other OPEC members, urging the members to keep the group out of politics. On Sunday, Iran called out Saudi Arabia for offering to produce additional oil in the face of U.S. sanctions on Iranian oil. “No country is allowed to take over the share of other members for production and exports of oil under any circumstance, and the OPEC Ministerial Conference has not issued any license for such actions,” Iran’s oil ministry news agency quoted Kazem Gharibabadi.

In other news, talk that the U.S. may impose sanctions on China for importing oil from Iran after its deadline of November 4 continues, further deteriorating the relationship between the two largest economies in the world, creating additional uncertainty in the market. Traders will continue to monitor both global energy demand and fundamental U.S. inventories to determine where the market is heading in the coming weeks.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.