Iran: No War, No Negotiations

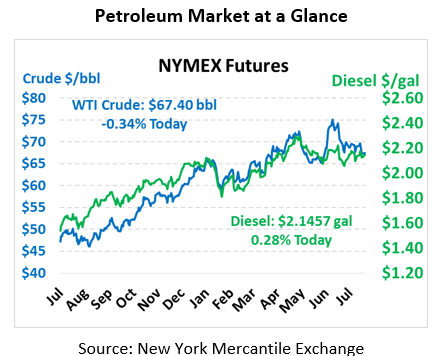

Mixed news coming from Iran yesterday is keeping prices elevated this morning. Crude ended the day with just small losses of 40 cents, despite losing $2 during morning trading. This morning, prices are trending higher once again. WTI Crude is trading at $67.99, a gain of 79 cents (1.2%).

Fuel prices were a similar story, falling briefly yesterday morning before recouping their losses. This morning, both are heading higher. Diesel prices are trading at $2.1640, a gain of 2.7 cents (1.3%). Gasoline prices are $2.0589, leading the complex higher by gaining 4.4 cents (2.2%).

Yesterday, Iran’s Supreme Leader Khamenei announced Iran will not negotiate with the US over the nuclear deal, but also would not be drawn into war. The good news at the end was overlooked by markets who focused primarily on negotiations being taken off the table. It’s not surprising – Iran has withstood the whole world sanctioning them, they can withstand losing trade with the US and companies doing business in the US. China, India, Europe, and others have all agreed to maintain their trade relations with Iran, in exchange for Iran continuing to comply with the nuclear deal. Trump reimposed sanctions trying to achieve a more comprehensive deal including Iran’s missile testing program and funds going to groups like Hezbollah.

On the bearish side, a survey found that markets expect Cushing inventories to rise this week, which would be the first increase in several weeks. Cushing, OK is the delivery point for WTI crude, making it symbolically important for the contract’s price direction. Stocks have steadily fallen ever since the Syncrude outage in Canada, which typically shipped fuel down to OK. Markets have apparently normalized enough to allow for supplies to begin ticking higher once again.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.