Will Iran Sanctions Work?

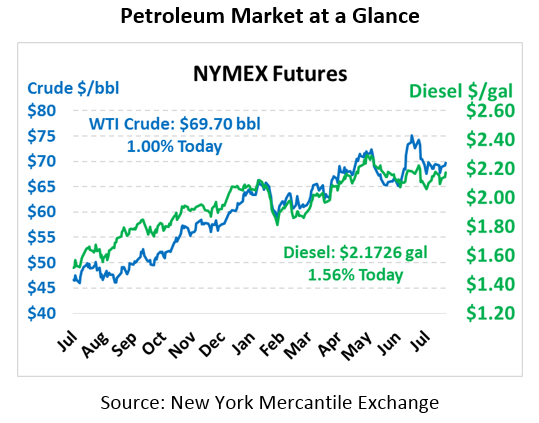

Oil markets are aiming up again this morning following yesterday’s small gains. Oil has been fairly range bound at $65-$75 since March, a range that we expect could continue for the remainder of 2018 before higher prices come in 2019. Crude oil is trading at $69.70 this morning, picking up 69 cents (1.0%).

Gasoline and diesel prices are also rising this morning. Gasoline prices actually ended yesterday slightly in the red, but this morning prices are seeing significant gains. Gasoline prices are currently $2.0953, adding 3.0 cents (1.5%). Diesel prices are $2.1726, gaining 1.2 cents yesterday and 3.3 cents (1.6%) this morning.

Markets are responding positively to news that Saudi oil production declined 200 kbpd in July after increasing in June. Saudi Arabia and Russia both agreed to increase production to fill the void left by Venezuela and Iran, but after increasing production in June, Saudi Arabia noted there wasn’t enough demand for their crude to justify the increase. OPEC production was at 126% compliance in June, down from well above 150% in the previous months. Although Saudi Arabia increased production, nearly every OPEC member is lagging in production, keeping overall OPEC output low (and prices high).

Will Iran Sanctions Work? Does It Matter?

The first round of Iran sanctions went into effect at midnight last night. This first wave stops short of hitting Iran’s oil industry, targeting its financial and manufacturing sectors instead. Global markets have until November 4th to comply with the full sanctions on all trade with Iran, though recently Trump has hinted at the possibility of certain countries or companies getting waivers.

Iran sanctions have certainly given markets a fright the past few days, but virtually everyone except the US is working hard to ensure they won’t have an impact. China has agreed to maintain its normal trade relations with Iran, though they likely will not increase imports. The latest news is that the EU today passes a blocking statute allowing European companies to sue the US for damages from sanctions. The measure also bans companies from withdrawing their business relationship with Iran unless they receive exceptional authorization from the European Commission.

China and the EU are Iran’s top trading partners, following by India, South Korea, and Turkey. Of these five countries, only South Korea is actively complying with US sanctions, and even they have asked for an exemption. Outside the US, support for the Iran nuclear deal (the JCPOA) was very high – America is going it alone imposing sanctions. Of course, even with political cover from political leaders, companies in the EU, China, and India face a tough choice – trade with the US or with Iran. Any foreign company currently trading with the US will likely choose the former, for purely economic reasons.

All of these difficult layers of trade work in Iran’s favor. They’ve survived years of sanctions in the past when the whole world was ganging up on them. Now that it’s just the US imposing sanctions, Iran has more support than they did last time. Trump’s stated goal is to bring Iran back to the negotiating table by imposing crippling sanctions, yet these sanctions are less severe than ones imposed in the past because fewer countries are participating. Additionally, sanctions can impose a “rally around the flag” affect in which Iranian nationalists blame outsiders for their economic woes, rather than seeking internal change.

What that means for us is that Iran sanctions are likely here to stay, at least during this administration. Iran produces about 2 million barrels per day of crude oil, and analysts expect roughly 1 million of that to fall off the market post-sanctions. Given that Iran is being thrown an economic lifeline by nearly every other country, it appears the 1 MMbpd loss will continue for the next few years, keeping prices higher for the long-term.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.