Oil Pulls 180⁰ Turn, Now Higher

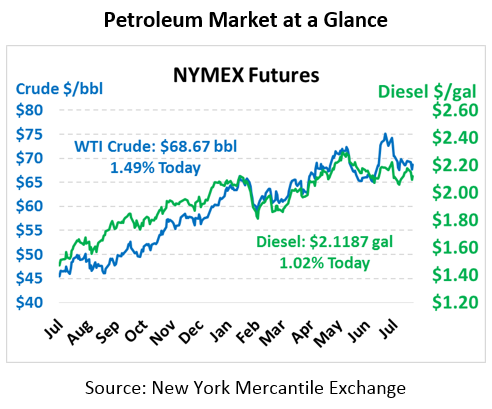

Oil prices pulled a 180⁰ turn this morning, plummeting to just above $67 before rallying above well $68. In a fundamentally balanced market, prices are whipsawing back and forth right now putting us a bit higher for the day. Crude oil is currently trading at $68.67, a gain of $1.01 (1.5%) since yesterday’s close.

Fuel prices are also sharply gaining speed. Diesel prices have shed 6 cents since Monday’s high close, while gasoline has shed a whopping 12.5 cents (8.4 cents were lost yesterday). Fuel prices reversing this morning, with diesel prices currently trading at $2.1187, a gain of 2.1 cents (1.0%). Gasoline prices are up 1.3 cents (0.6%) to $2.0580.

US-China trade is once again driving oil prices, pushing prices lower over the past few days. For a while, Trump has been threatening to impose a 10% tariff on $200 billion of Chinese imports. Now that tariff has been raised to 25%, and implementation looks likely. This has two impacts on prices:

- If China buys less American crude, demand for WTI would fall, causing prices to sink. While oil is fungible and it would get reshuffled elsewhere, buyers on other countries would have a bit less demand competition.

- China is considering buying more Iranian oil, since sanctions from the US won’t sting much if our trade is already plummeting. Markets are currently assuming 1 million barrels per day of Iranian oil will fall off the market when sanctions are imposed; if those barrels go to China, it could keep prices lower.

EIA Data

The EIA’s weekly data report was a major contributor to the price drops. While not as bearish as the API’s report, it did confirm that crude inventories gained 3.8 million barrels, and diesel stocks picked up a similar 3 million barrels. Gasoline – ironically the biggest loser in price – also showed the sole decline in inventories.

Cushing inventories continued falling to 22 million barrels (compared to 70 million barrels a year and a half ago), a new multi-year low. Rock bottom for Cushing inventories was roughly 18 million barrels in 2014, so markets could become bullish again if Cushing stocks test that low.

Contributing to fuel’s momentous decline (relative to crude) has been strong refinery utilization. Utilization rose to 96.1%, a 2.3 percentage point gain, as refiner margins remained strong. Many refineries around the country are benefitting from cheap crude from other countries – nowhere is this truer than in the Chicago/Midwest market, where refinery utilization spiked 5.8 percentage points to 99.1%! Canadian crude, the main feedstock for Chicago refineries, is steeply discounted to WTI prices, allowing refineries to buy low and sell high fuel prices. Canadian crude is generally $10-$20 cheaper than WTI – which is a 25-50 cent price advantage for Chicago refiners.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.