Week in Review

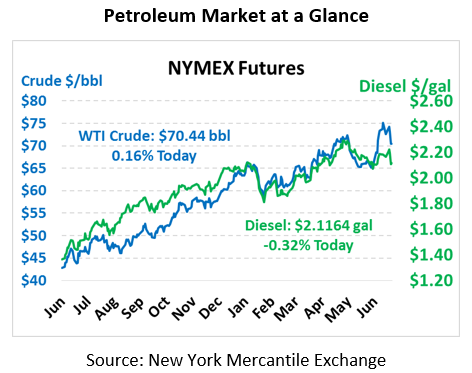

After Wednesday brought the largest single-day crude price drop since August 2015, markets have stabilized, with prices yesterday ending just slightly above Wednesday’s close. This morning, prices continue to show meager gains. WTI crude oil is currently trading at $70.44, a gain of 11 cents.

Fuel prices are also trending slightly higher after their losses. Gasoline prices rose a penny yesterday, while diesel picked up two cents. This morning, gasoline prices are $2.0752, a gain of 0.4 cents over yesterday’s close. Diesel prices are $2.1164, representing a loss of 0.7 cents.

Market direction is lacking this morning as little news has surfaced since Wednesday’s sell-off. Bloomberg reported that OPEC deal compliance has fallen to 126%, down from 160%, thanks to increased production from Saudi Arabia. The IEA released their monthly energy report basically telling markets what they already expect – that demand has been strong but is expected to decline in the latter half of the year, and global supply has been rising. In particular, the report notes that overall markets are balanced or slightly oversupplied (implying lower prices), but the constant threat of outages makes price volatility certain.

Week in Review

Yesterday’s news did a great job summarizing some of the key price drivers this week, so we’ll summarize from those details:

- Libyan Production – Libyan production, which had fallen by a whopping 850,000 barrels per day due to political instability, came back online, replenishing the market.

- Iran Sanction Waivers – After months of issuing strict, zero-tolerance type statements on Iran sanctions enforcement, the State Department this week allowed for the possibility of some countries getting waivers.

- Trump’s Tariffs – The trade war not only hurts the overall economy and weakens demand – it’s also caused 16 million barrels of crude heading to China on ships to re-route elsewhere. Good for consumers globally, but certainly not good for Chinese consumers who now must pay higher prices on American oil.

- Syncrude Returns – Canada’s Syncrude operation will bring 150 kbpd back to the market in July, while full operations of the 360 kbpd project will resume by September. The news is less optimistic than markets had hoped for, but the timeline clarity has still helped alleviate fears of shortages in Cushing, OK inventories.

- Massive crude inventory draw – while every other factor has created downward pressure, this one should not slip by unnoticed. Crude inventories fell 12.6 million barrels, with draws in every region of the country. Of course, most of the draw was attributable to declining imports, which for the week were 11 million barrels lower than the week previous. The draw brings America’s total crude days of supply to just 22.9 days, the lowest level since January 2015.

Price Review

The trend for the week was towards lower prices across the board as Trump’s tariffs pummeled all commodities classes. Crude prices opened on Monday at $73.87 after hitting a high above $75 last week. Prices this week once again made a play for $75, but could not quite sustain enough momentum to reach that level. On Wednesday, the bottom fell out from the market, and prices plummeted $3.73 day-over-day. The rest of the week was fairly stable, with prices mainly trending above $70. Crude opened this morning at $70.38, a weekly loss of $3.49 (-4.7%).

Diesel prices, like crude, rose right up until they crashed. Diesel prices began the week at $2.17 before rising higher to nearly $2.23. But those gains would not prove sustainable, and prices came crashing down to $2.09 on Wednesday, ending the day at $2.10. This morning, diesel prices opened at $2.124, a loss of 4.65 cents (-2.1%) – less than half the size of crude’s losses on a percentage basis.

Gasoline had the weakest losses for the week, though Wednesday’s losses were steep. Gasoline opened the week at $2.1075, and quickly rose to $2.17 before reverting lower. Gasoline prices lost 5% on Wednesday from the daily high to the closing price, yet losses for the week were just 3.5 cents (-1.7%), showing gasoline’s relative weakness coming into this week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.