Week in Review

Although the week was shortened by a mid-week holiday, markets still saw significant price swings, rising to multi-year highs before giving up their gains. Markets panicked over the weekend when Trump tweeted Saudi Arabia had agreed to a 2 million barrel per day production increase – then rose Monday when his administration clarified Saudi Arabia had actually only agreed to fill in product cuts as needed, a much more nebulous commitment.

Although markets remain unclear on exactly what OPEC’s commitment to increase production entails, there was talk of higher production from the Saudis and Russia in June, with Saudi exports rising 330 kbpd and Russian production rising 100 kbpd. OPEC functionally agreed to a 1 MMbpd production increase a few weeks ago, but only a few countries have the spare capacity to increase production. OPEC exports did manage to increase by 1.3 MMbpd in June thanks to Saudi and UAE output hikes.

While Saudi Arabia and Russia have been increasing output, however, other countries have seen production fall. Venezuela and Iran are the obvious culprits; losses from those two are what spurred OPEC to up its production. But Libya’s production is also down 850 kbpd amid political strife, and Canada’s Syncrude outage is reducing Canada’s exports by 350 kbpd. Combined, those two unexpected outages are keeping oil supplies tight globally, keep prices elevated.

One final scenario is looming over the market, though so far markets have not considered it credible enough to worry about. Iran has been threatening this week to cut off supplies in the Strait of Hormuz if America tries to enforce sanctions on Iranian oil. The State Department has been abundantly clear that they are taking a strict approach to sanctions, putting the ball in Iran’s court. Shutting down the Strait would be devastating to Iran’s own economy, though, and in a naval war between Iran and the full might of the United States Military…well, you guess who would win.

Price Review

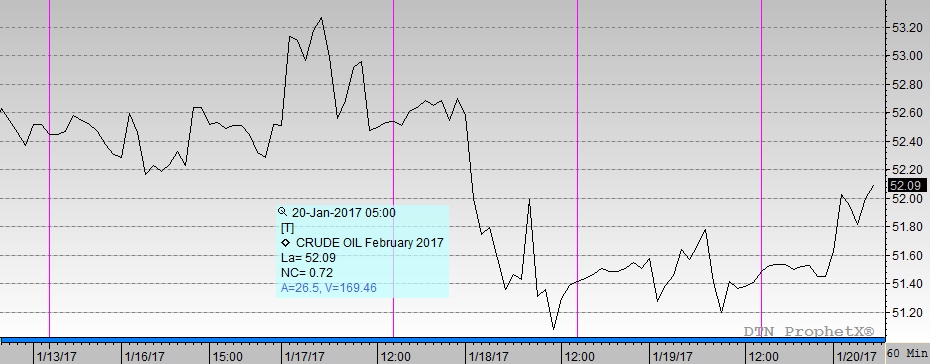

Crude prices opened the week at $73.62, rising as markets recovered from Trump’s tweet on Monday. Prices remained high as supply outages weighed more heavily on markets than OPEC production increases, extending high prices through the Wednesday holiday. Thursday, however, saw prices begin to fall rapidly following the EIA’s inventory report. A net build for crude oil inventories – bucking the trend of draws – caused markets to revert to lower prices. WTI crude opened at $73.16 this morning, a loss of 46 cents, with more losses continuing this morning.

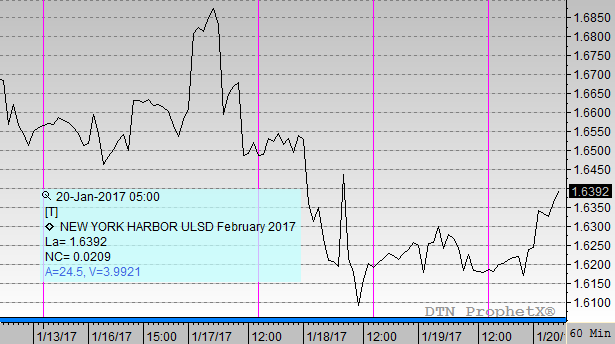

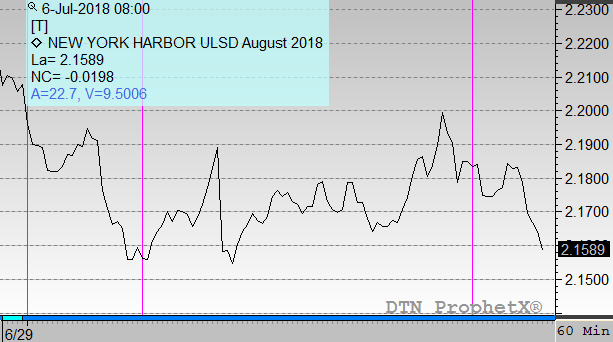

Fuel prices seemed to move out of sync with crude oil for part of the week – falling on Monday in contrast to crude’s rise, and rising on Thursday while crude fell. While speculation drove crude prices lower later in the week, total product demand spiked to its highest level in 30 years, and diesel demand was above 4 million barrels per day. Diesel prices opened the week at $2.2057 and quickly fell lower, never returning to that opening high. Diesel prices opened this morning at $2.1852, a loss of 2.1 cents (-0.9%) for the week.

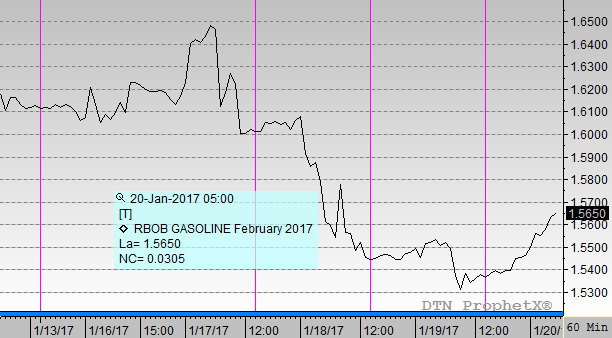

Gasoline prices tracked closely with diesel prices, getting a boosts from overall robust summer fuel demand that forced suppliers to cut exports to keep local supplies high enough – resulting in exports falling 126 kbpd compared to last week. Still, that hasn’t helped prices today, with the whole oil complex slipping lower. Gasoline opened the week at $2.1468; unlike diesel prices though, gasoline prices did briefly surpass that opening price threshold yesterday when prices peaked above $2.15. Gasoline opened at $2.1355 this morning, a weekly loss of 1.1 cents (-0.5%), with further losses materializing as the morning continues.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.