OPEC and Tariffs Create Uncertainty in the Market

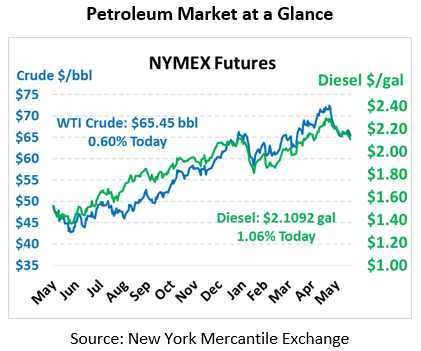

The market experienced a major sell-off on Friday following the announcement of U.S. tariffs on China. Oil prices started the day higher before plummeting nearly $2 before closing on Friday. This morning, prices opened 66 cents lower than Friday’s close, but have since gained some strength. Crude prices are currently trading at $65.45, a gain of 39 cents over Friday’s close.

Like crude oil, fuel prices are in positive territory this morning following huge losses on Friday. Diesel and gasoline prices both gave up over 7 cents (3%) on Friday. Diesel prices are making a minor recovery this morning trading at $2.1092, a gain of 2 cents. Gasoline prices are also seeing small gains (relative to Friday’s losses) of a penny and a half to trade at $2.0387 this morning.

China Threatens to Impose Tariffs on U.S. Oil

On Friday, President Trump announced tariffs on $50 billion worth of Chinese goods, starting July 6. In response, China threatened to impose duties on various American commodities, including natural gas, crude oil and other petroleum products. In the past 3 years, China has become a major buyer of U.S. oil as production cuts from OPEC and Russia have taken supply off the market. China imports an estimated 563,000 barrels of American crude and petroleum products every day according to the U.S. Energy Department.

A study from Reuters shows the value of U.S. crude shipments to China have increased significantly over the past year, jumping from $100 million per month in early 2017 to almost $1 billion per month currently. The potential tariff would make American oil more expensive than supply from other regions, sending Chinese purchases elsewhere. A cut in Chinese imports could leave additional product trapped in the U.S., sending WTI prices sharply lower.

A cut in Chinese purchases from the U.S. would benefit other suppliers, namely Iran. China is the world’s largest importer of Iranian oil, so it is likely for China to replace some American crude with oil from Iran. This could further deteriorate the relationship between the U.S. and China as the U.S. recently placed sanctions on Iran. Escalating tension around OPEC’s production decision coming later this week and fears of a potential trade war have created a volatile market for oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.