Contradictory EIA Data Causes Rally

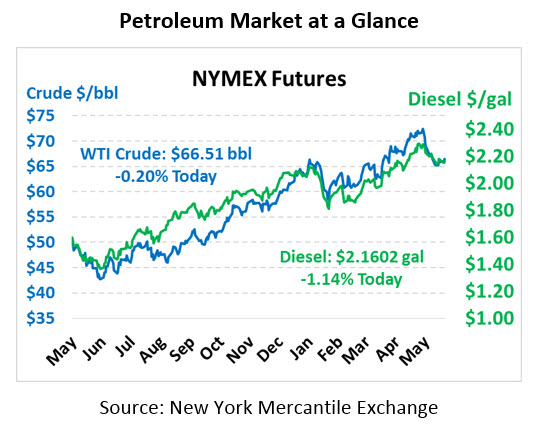

Markets picked up steam early this morning after yesterday’s EIA report contradicted market expectations and API data, but are the rally is beginning to fade. Crude prices saw meager gains yesterday to the tune of 30 cents, and this morning prices are making similar gains. Prices are currently $66.21, down 13 cents since yesterday’s close.

Fuel prices saw an uptick yesterday, with diesel prices rising 2.3 cents and gasoline gaining 3.5 cents. This morning, those gains have been completely reversed. Diesel prices are currently trading at $2.1602, down 2.5 cents since yesterday’s close. Gasoline prices are $2.0906, down 3.5 cents.

Contradictory EIA Data Causes Rally

Yesterday’s rally was the result of the EIA’s inventory report, which showed across-the-board draws for crude, gasoline, and diesel. Contrast that with the across-the-board build reported by the API. The steep draws were caused by large gains in both diesel and gasoline demand, which both rose by 900 Kbpd compared to the prior week.

In particular, gasoline demand was in focus. Last week’s gasoline demand numbers were the lowest weekly numbers since December 2016 – highly unusual given that summer demand is generally higher. This past week, gasoline demand soared to its highest level since last summer, representing an 18% swing between weeks. Weekly fuel demand does tend to be highly volatile, but swings that large are still unusual. The significant difference helped gasoline prices achieve their 1.7% gains yesterday, though those gains have disappeared today.

Other Market Movers

Markets continue to watch OPEC for any early indications of the outcome of their June 22 meeting. Saudi Arabia and Russia are continuing to push for a production increase, though some sources say they’ve changed their approach to include a two-step increase over time. Iran and Venezuela have vehemently protested the increase, saying that it seals their fate of lower market share and declining revenue. Russian President Putin and Saudi Arabia’s crown prince are meeting today to discuss the arrangement.

On the less speculative side, the Fed announced an interest rate hike yesterday and indicated that at least two more hikes are likely this year. Surprisingly, the US dollar saw meager losses yesterday, but today the dollar has seen strong gains that are creating headwinds for oil prices. Although we haven’t mentioned the relationship recently, crude oil prices are inversely related to the US dollar. As interest rates rise and make the dollar more attractive, foreigners have to pay more to get the US dollars needed to buy oil futures, reducing demand for oil trades and causing prices to fall.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.