G7 Kerfuffle Creates Long-term Uncertainty

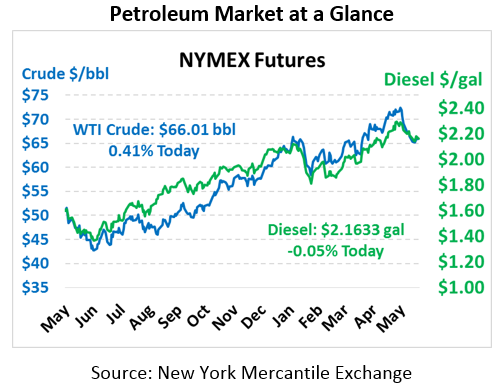

Oil prices started the day with some losses, followed by steady gains later in the morning. Crude finished on Friday just slightly below the previous day’s close – lack of large movements has been a notable characteristic over the past week. This morning, prices fell as low as $65.00 before shooting up. Crude prices are currently trading at $66.01, a gain of 27 cents over Friday’s close.

Unlike crude oil, fuel prices are in the red this morning. Diesel prices gave up roughly 1.5 cents on Friday, while gasoline actually stayed just marginally in the black. Diesel prices today are $2.1633, a loss of 0.1 cents. Gasoline prices have caught up to the market, losing 1.2 cents this morning to trade at $2.1029.

G7 Kerfuffle Creates Long-term Uncertainty

Over the weekend, the G7, a group of some of the largest developed countries in the world, met to discuss global issues. President Trump created some controversy at the G7 meeting, skipping meetings related to climate change and notably refusing to sign the group’s statement due to disagreements on trade tariffs. In particular, Trump called out Canadian leader Justin Trudeau for imposing tariffs on the U.S. while opposing tariffs generally. The rift sends a perception to allies that the U.S. is not cooperating with the other major powers, causing trading partners to fear that more tariffs could be on the way.

In contrast to the tumultuous G7 meeting, China and Russia invited India and Pakistan to join the Shanghai Cooperation Organization’s meeting. The SCO is a group of Asian countries implicitly rivaling the G7 and America’s influence in Asia. While the G7 was struggling to maintain a show of unity, the SCO was growing its influence by including new members in its trade talks. Many consider the Shanghai Cooperation Organization to be a means for China to project influence, expanding economic integration with regional countries as part of their Belt and Road policy (developing East Asian infrastructure).

Although the geopolitical kerfuffle does not directly impact oil prices, the long-term trends at play are certainly relevant to global oil trends:

First, any threat of trade tariffs in the future is bearish for oil, as it foreshadows decreased economic (and fuel) demand. Tariffs are rarely set in isolation – just like China and the U.S. escalating their proposed tariffs on one another, other countries could impose retaliatory tariffs on American goods if America begins putting up trade barriers.

Second, China’s growing influence in the world is mirrored in their recent launch of a major oil futures index rivaling Brent or WTI oil. This may not directly impact prices, but it could change how half the world prices their crude oil, which will certainly have a big impact on traders and technical market dynamics. As they expand their influence and invest in projects that put China in the middle of global trade, their oil market could quickly grow to rival Brent and WTI markets.

Third, any instability begets uncertainty for oil markets, whether it is between the U.S. and our allies or between the East and the West. Markets hate uncertainty, so instability causes oil prices to trade at a premium. This was seen before the Syria strikes last quarter, in the lead up to America’s withdrawal from the Iran Nuclear Deal, and throughout other geopolitical events. While no direct conflicts emerged from this weekend’s meetings, future tensions based on Trump’s activity this week could create uncertainty for oil markets, causing prices to rise.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.