US Temporarily Insulated from Global Supply Shortage

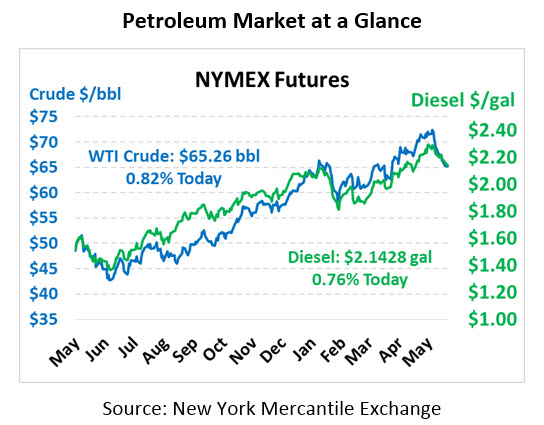

Oil prices are trending a bit higher once again, despite the very bearish news reported yesterday by the EIA. Crude prices fell by 80 cents yesterday, but this morning WTI crude prices are up 53 cents, trading at $65.26.

Fuel prices are also trading higher this morning, after notable losses yesterday. Large stock builds caused prices to plummet, but crude builds are helping to support fuel prices. Diesel prices are trading at $2.1428, up 1.6 cents since yesterday’s close. Gasoline prices are at $2.0819, 1.2 cents higher than yesterday.

EIA Inventory Data

American fuel markets responded very negatively to yesterday’s EIA inventory data, with prices falling quickly after the 10:30am release. While traders expected a modest crude draw along with small fuel inventory builds, the data showed large across-the-board gains in petroleum products. With overall petroleum product inventories building over the past few weeks, some are beginning to think the destocking pattern experienced over the year could be slowing.

U.S. Insulated from Global Oil Shortages (For Now)

Internationally, Brent (European/international) crude prices look completely different than American oil. Because U.S. export capabilities are still in the process of maturing, we’re relatively insulated from the supply shortages being experienced globally. European countries are cutting ties with Iran in response to American sanctions, forcing them to turn to other Middle Eastern crude suppliers and driving up costs.

Because U.S. exports very little to Europe, the call for U.S. exports has not changed significantly. Thus, plenty of product remains domestically despite international supply shortages, resulting in a $10 price spread between American oil and Brent crude oil prices. As American pipeline and export infrastructure matures, expect those spreads to narrow, with WTI prices rising to catch up to Brent oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.