FN Price Update

Due to the Mansfield Cares Golf Classic, today’s article will be a brief price update only. To learn more about the Golf Classic or to contribute to Mansfield Cares, you can read more here.

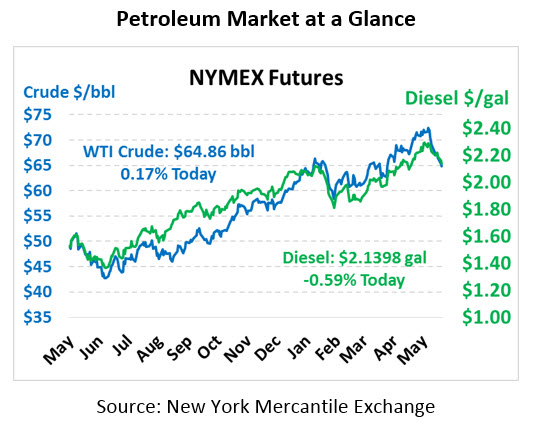

Markets closed lower yesterday, shedding roughly a dollar from the previous day’s close. Early this morning prices are up just slightly, gaining 11 cents since yesterday’s close. Crude prices are currently $64.86.

Fuel prices are experiencing significant losses this morning after both products saw nearly two-cent losses yesterday. Diesel prices are currently trading at $2.1398, a loss of 1.3 cents. Gasoline prices are trading at $2.1106, a loss of 1.2 cents.

Markets are the most bearish they’ve been in about 6 months, with market shorts (bets that crude prices will fall) increasing. As usual, traders are focused on the rumors of increased production. Of course, the bearish trend will likely play out before the June 22 meeting – markets will find a stable level until OPEC gives some firm direction.

Remember the lead up to OPEC’s announcement on maintaining cuts last year? Markets rose quickly in the weeks leading up to the announcement, yet immediately following the announcement prices fell. Given that OPEC’s current decision is the first significantly bearish headline in months, markets could well be over-hyping the rumor, with an upward correction coming after a decision. Of course, a strong commitment from OPEC to increase production could feed into the market’s downward momentum and lead prices back towards $60 as well.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.