Week in Review

After two weeks of trading at multi-year highs, prices have fallen back under $70/bbl this week and have traded in the $66-68/bbl range. News of OPEC and non-OPEC countries potentially increasing production by 1 MMbpd sent prices crashing last Friday and has kept a lid on prices this week.

WTI crude oil opened the week at $67.55/bbl, a drop of nearly $4 from the previous week’s opening price. Prices rose on Wednesday, reaching a peak of $68.67 before beginning declining on Wednesday following a bearish API report. This morning, prices opened at $67.07 and are trending lower. This week is set to end in the red.

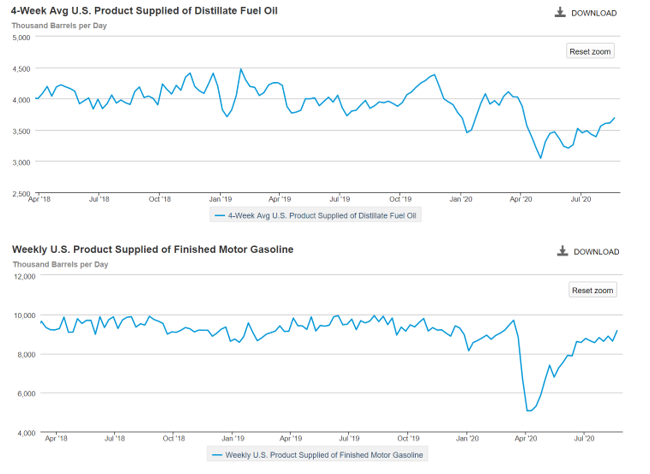

Diesel prices opened the week at $2.2000 and rose as high as $2.2400 on Thursday. A diesel inventory build put downward pressure on prices beginning on Wednesday and continuing into today’s session. Diesel opened at $2.2098 this morning, and like crude, is continuing to trend lower. Unless losses are reversed this afternoon, the week appears destined to end well in the red as well.

Gasoline prices opened the week at $2.1701. Prices fell sharply on Tuesday before reversing those losses and more on Wednesday. Gasoline rallied on Thursday, reaching its weekly high of $2.2070 before falling back to lower ground at closing. This morning, prices opened at $2.1656 and are following crude and diesel into negative territory for the week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.