Budget Thoughts for 2019 and the Minnesota B20 Mandate

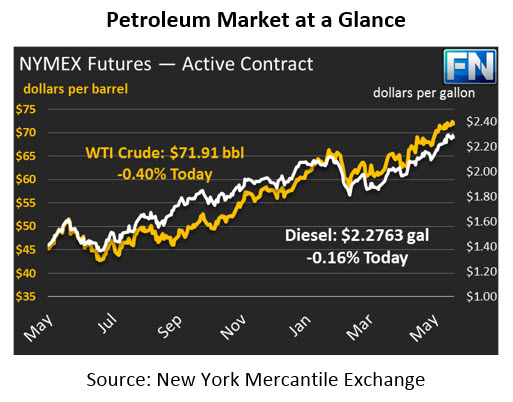

The oil complex is down across the board this morning. Crude traded down during yesterday’s trade, closing the day a 40 cents lower. This morning, oil prices continuing to fall, losing 29 cents to trade at $71.91 currently.

Fuel prices are also showing loses this morning, tracking crude lower. Product prices moved in opposite directions on Monday with diesel ending the day lower and gasoline higher. Diesel prices are down 37 points this morning, trading at $2.2763. Gasoline prices are down to $2.2577, a loss of 1.25 cents.

Budget Thoughts from Pricing Expert Jay Blanton

Over the last several weeks I have received numerous requests for fuel price forecasts specifically regarding 2019 budgets. Many of our customers missed the mark last year especially those who typically lock in prices in order to protect their budgets. Seeing very little price relief ahead of the summer, I thought I would suggest a high level concept when determining fuel budgets.

I have spent the last 20 years presenting risk management strategies to a myriad of industry verticals and I have come to the conclusion that one thing is for certain; there is no definitive methodology used for setting budget rates. Every company I have spoken to seems to use different methods. Some utilize historical average prices based on their purchases, others will use the current fuel price and incorporate an “adder” to derive their budget number. Very few will use the forward market as a guide.

Of each of these methods, using the forward curve is most advantageous. Especially for those who lock in their budget rates. If your company locks in its total fuel price exposure, there should be close to zero variance to budget when using the forward curve method. Why? Because it represents where your company can lock in prices now. In future articles I will speak to additional considerations when determining fuel budgets. For additional questions about fuel budgets, price risk protection or the forward curve methodology, email me at jblanton@mansfieldoil.com.

Inventory Levels

The API released their weekly inventory data yesterday, which showed draw in crude and diesel and a small build in gasoline. Excluding the build in gasoline, the report was mostly aligned with the market’s expectations. The EIA report will come out later this morning to confirm these estimates.

Minnesota Suspends B20 Mandate until June 30th

On May 1, 2018 the state of Minnesota implemented the B20 mandate, which requires all diesel fuel to contain at least 20% biodiesel. Due to a lack of biodiesel production in the area, there is an insufficient supply to meet the current B20 mandate. The State of Minnesota has temporarily suspended the B20 Mandate until June 30th to allow time for biodiesel plants to increase production. Because of these supply constraints, the minimum biodiesel mandate has been reduced from 20% to 10% biodiesel.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.