OPEC Discusses Supply Agreement Changes

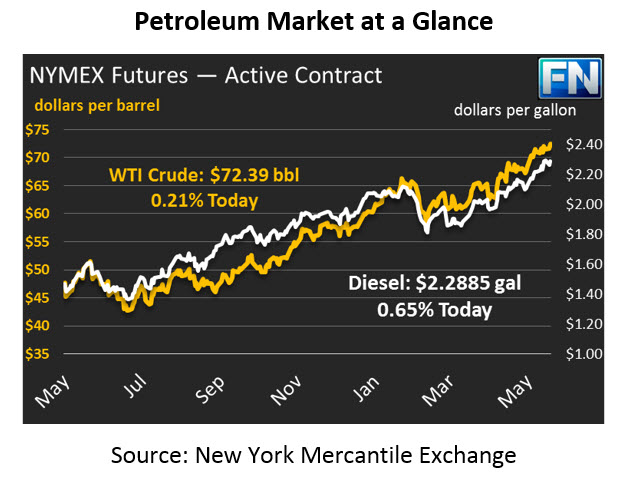

Prices continue to march higher across the oil complex this morning. Crude prices ended yesterday 77 cents higher. This morning, crude is holding on to yesterday’s gains and making small upward movements. WTI crude prices are $72.39 currently, an increase of 15 cents.

Fuel prices are also rising this morning. Diesel prices gained less than a penny yesterday, while gasoline prices picked up over 2 cents. This morning, diesel has picked up steam, with prices up 1.47 cents at $2.2885. Gasoline prices have gained just under a penny this morning to trade at $2.2661.

Rumors have begun spreading that OPEC could increase their production quotas, given Venezuelan supply disruptions and the threat of Iranian oil coming off the market. Back when Trump announced America’s withdrawal from the Iran nuclear deal, Saudi Arabia hinted that they would be willing to fill in the lost supply. Current chatter appears to be an extension of this comment. While the talks have not been firmly announced, the rumor could cause markets to settle in the short term.

As part of the Venezuelan production threat, on Sunday the country voted to re-elect President Maduro, in an election that was widely regarded as illegitimate. The Trump administration has threatened stricter penalties on the regime if Maduro was reelected, so markets are speculating over what type of action America could take. While few expect sanctions directly on Venezuelan crude oil, some do suspect sanctions could be placed on exports of diluents to Venezuela. Diluents are very light-end products that help Venezuelan crude oil flow through pipelines more efficiently; removing diluents would slow down Venezuelan crude exports. Venezuela’s on-going production challenges have caused OPEC compliance on the production cuts to be well over 100%, so OPEC is considering loosening production requirements on other countries.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.