OPEC Report Shows Economic Uncertainty

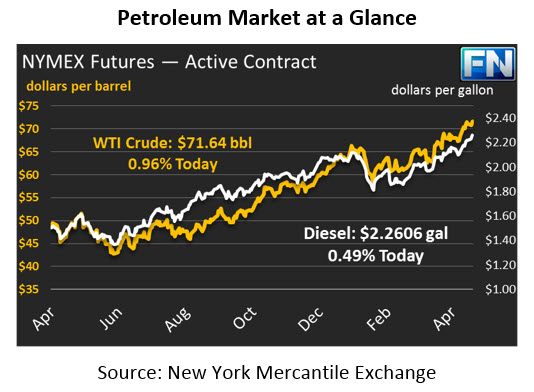

Oil prices are back to setting new record highs this morning, with markets peaking just shy of $72/bbl this morning before falling a bit lower. Crude prices ended yesterday about 20 cents in the positive. This morning, WTI crude prices are $71.64, an increase of 68 cents (1.0%).

Fuel prices are also rising this morning, following big gains yesterday. Diesel prices gained a whopping 2.7 cents yesterday, while gasoline prices picked up just 1.1 cents. This morning, diesel remains the bigger winner, with prices up 1.1 cents (0.5%) at $2.2606. Gasoline prices are struggling to keep up, gaining 0.6 cents (0.3%) to trade at $2.2062.

Market Movers

Markets received a big influx of news yesterday, most of which helped to prop up fuel prices. One of the primary drivers of the overnight rally was the opening of the American embassy to Israel in Jerusalem, which has long been politically taboo. The embassy had previously been located in Tel Aviv, a more neutral location. Large protests by Palestinians were met by extreme force, with over 2,500 protestors injured and 58 killed. While Israel is not particularly important in the sphere of the oil supply chain, instability in the area creates uncertainty for the whole region, which generally causes oil prices to rise.

OPEC also released their monthly oil report, which showed a very slight increase in OPEC production over the past month. Venezuela’s on-going instability has put significant portions of production in jeopardy. Adding to the country’s struggles, ConocoPhillips has seized a storage a shipping facility in the Caribbean, near Venezuela. The loss of this facility will limit Venezuela’s imports of diluents and refined products, which could hinder production and exports.

Analysis indicates that Venezuelan production, which has already fallen 40% over the past year to just 1.5 MMbpd, could continue falling as low as 1.1 MMbpd by the end of the year. The EIA forecasted in March that Venezuelan production will continue to fall “through at least the end of 2019.”

While many of the headlines currently support higher prices, OPEC did note that global economic growth prospects are growing more uncertain, thanks to U.S. trade policies and sanctions on Russia. While the organization predicts 1.65 MMbpd global oil demand growth in 2018, they noted that economic data in developing countries and Europe point towards weakening growth rates. OPEC’s analysis did not include an in-depth outlook on Iranian sanctions, which will likely contribute further to uncertainty while also decreasing global oil supplies.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.