Week in Review

Iran Nuclear Deal Rules the Week

Markets took flight this week, with the Iran nuclear deal being the major price mover of the week. Trump’s threat of severe sanctions on any company trading with Iran has given the market fear of future production shortages. Saudi Arabia announced that OPEC would fill in the gap, but that likely will not make up for 100% of the Iranian production falling off the market.

Of course, America’s withdrawal from the deal does not completely sink the deal, but European and other countries now must re-assure Iran that they will uphold their end of the bargain. Overall, expect the net result of Trump’s withdrawal to be reduced global oil supplies and rising prices.

Biofuel Policy Change Sneaks Through

While markets were hyper-focused on the Middle East, the White House made some significant changes in biofuel policies. For the past few years, renewable fuels like ethanol and biodiesel have been supported by a subsidy called RINs (Renewable Identification Numbers) put in place by the Renewable Fuels Standard (RFS). Those RINs are produced along with each gallon of biofuel, and must be purchased by refineries to offset petroleum production.

This week, Trump announced a policy waiver that allows E15 gasoline to be sold year-round (previously, it could not be sold in the summer for environmental reasons). That means more demand for ethanol – a win for biofuels producers (because they can sell more) and a win for refineries (because more biofuel production will lower RINs prices). It will also offset gasoline demand by up to 5% as suppliers replace more gasoline with ethanol. The net result would be lower prices for consumers. The move is seen as a major win for the biofuels industry and consumers.

On the flip side, Trump is considering allowing exported biofuel gallons to qualify to create RINs. Currently, only biofuels consumed in the U.S. qualify. Biofuel producers are more skeptical of this change, since it would dramatically lower RINs prices (by increasing the supply of RINs-generating fuels) and would likely lead to retaliatory trade barriers from other countries targeting biofuels. Refineries, of course, are supportive of any policy lowering RINs prices.

Price Review

Crude prices started the week at $69.85, below the previous week’s close. Prices fell Tuesday as markets struggled to understand the implications of Trump’s announcement on Iran – given the 90-180 day period before sanctions were reinstated, some thought there was hope that Iran’s supply could be preserved. But market sentiment gave way to the realization that Trump would follow through on his threats and Iranian supply would be reduced.

Markets soared on Wednesday following this realization, and received additional support from EIA data confirming a solid inventory draw for the week. Prices have remained stable in the back half of the week, with prices opening at $71.45 this morning, a gain of $1.60 (2.3%).

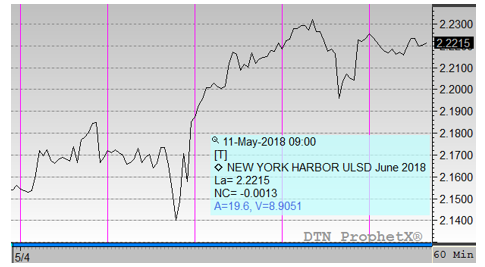

Diesel prices opened the week at $2.1717, trading steadily until Tuesday when prices soared along with crude oil prices. The API and EIA both reported inventory draws that exceeded market expectations, which helped send prices even higher. Diesel prices opened this morning at $2.2242, a gain of 5.3 cents (2.4%).

Gasoline traded in line with crude prices this week, with the biggest gasoline-specific news coming in the form of Trump’s changes to ethanol blends. The EIA also reported continued strong demand and low production of gasoline at refineries, who are taking longer than usual to get through turnaround season. Gasoline prices opened this week at $2.1174, and opened this morning at $2.1909, a gain of 7.4 cents (3.5%).

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.