Managing the Supply Shortages

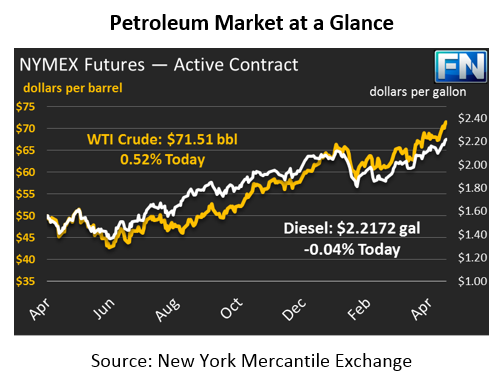

Markets are pushing still higher this morning, building on their momentum from yesterday’s bullish EIA data. Crude gained over $2 (3%) in yesterday’s session, more than offsetting Tuesday’s losses, as markets continue to parse through Trump’s withdrawal from the Iran nuclear deal. Today, crude prices are $71.51, gaining 37 cents since yesterday’s close.

Fuel prices are seeing meager changes this morning, with markets cooling after yesterday’s massive gains. Diesel prices added more than 6 cents (2.8%) yesterday. Gasoline saw the smallest gains yesterday among the three products, rising “just” 5.6 cents (2.6%). Today, diesel prices are currently $2.2172, down marginally since yesterday’s close. Gasoline prices are $2.1771, sustaining yesterday’s rally by gaining an additional penny.

The Iran nuclear deal continues to be the main reason for market volatility. The latest news is that Saudi Arabia has promised that OEPC will “mitigate” any supply shortages from re-imposing sanctions on Iran, though the statement does not necessarily ensure they will increase production proportionately to any disruption. Learn more about Saudi Arabia’s announcement.

Adding to the market volatility, the EIA’s inventory data showed across the board inventory draws that were much steeper than market expectations. The big takeaway from the report was diesel supply tightness – inventories are 34 million barrels below last year’s level, with most of the tightness focused in the eastern half of the country. With oil supplies tight across the world, many are wondering whether the Iran cuts will make it even harder to offset the growing supply deficit. Analysts expect diesel prices to outperform gasoline this summer, an unusual dynamic historically but less unusual looking towards future market trends. Refinery turnaround season will stretch a bit longer than usual this year, keeping production of new fuels a bit lower than the norm for May.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.