Today’s Market Trend

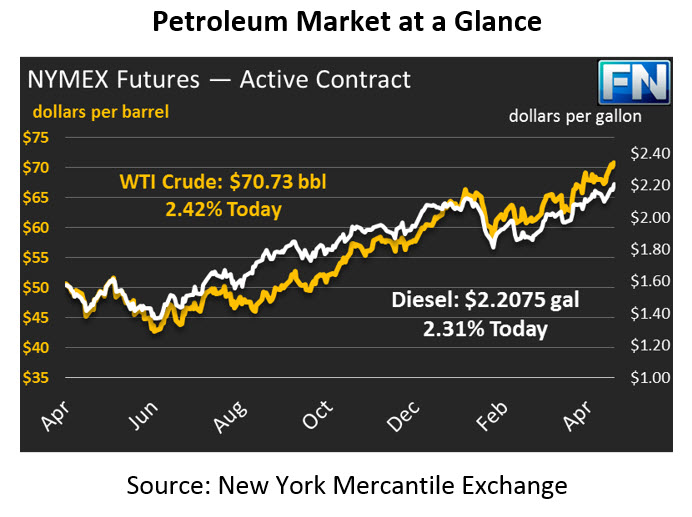

Oil prices are soaring this morning, following prices plummeting and correcting yesterday and ending roughly $1.75 below the previous day’s close. This morning, oil prices are pushing 3.5 year highs, with WTI crude at $70.73, up $1.63/bbl (2.4%) since yesterday.

Fuel prices are also showing large gains this morning, supported by higher crude prices. Diesel prices are up a significant 5.0 cents (2.3%) this morning, trading at $2.2075. Gasoline prices are up to $2.1541, a gain of 4.3 cents (2.0%).

Markets are reeling from Trump’s early decision to withdraw from the Iran nuclear deal and re-impose sanctions within the next 180 days. Although the deal is not dead – Iran and the EU are acting as if they’ve simply lost one member of a larger deal – the U.S. withdrawal does make deal enforcement harder. It also forces companies in the EU and elsewhere to choose between trading with Iran and the U.S.

Prices fell significantly leading up to Trump’s announcement as conflicting reports generated confusion. CNN even misreported that Trump was extending the waiver on sanctions. Notably, following the announcement, Goldman Sachs announced their summer oil price target of $82 for Brent ($5 above today’s price) may be too low, given Trump’s aggressive take on sanctions. Countries currently relying on Iranian oil were told to begin weaning off those imports immediately, or face sanctions in the next 3-6 months.

After Trump’s announcement, markets saw the highest trading volumes of the year as traders sought to ride the wave of higher prices. Although American production is soaring, it’s already priced into most forward-looking supply and demand forecasts. Disruptions to Iranian oil supplies have not been priced into most outlooks; in fact, most expected at least some increase in production from OPEC. Most analysis groups believe sanctions on oil prices could have a significant impact on prices, ranging from $5-$10/bbl over the coming year.

Adding to the overall air of higher prices, the API released their weekly inventory data, which showed huge across-the-board draws for petroleum products. While markets were expecting a draw, the API’s data showed a 2 million barrel draw from crude and gasoline stocks, along with a 6.5 MMbbl draw from diesel stocks. If the EIA confirms these numbers this morning, markets could climb even higher.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.