President Trump’s Decision on Iran Is Coming…Today!

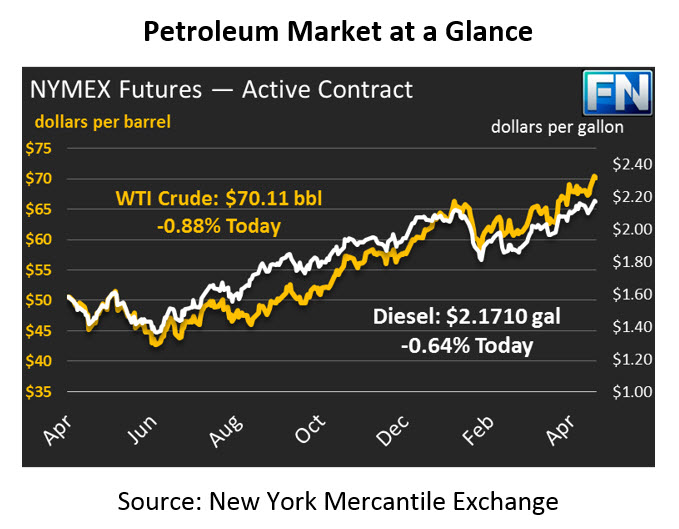

Oil markets are moving lower this morning across the board after reaching fresh 2018 highs on Monday. President Trump said yesterday that he would announce his decision regarding Iran this afternoon at 2pm, four days earlier than the expected May 12th deadline. Crude prices are currently $70.11, down 62 cents since yesterday’s close.

Fuel prices are also on the downward trek following lower oil prices. Yet again, diesel prices hit a new three-year record high yesterday. Diesel prices this morning are trading at $2.1710, a loss of 1.4 cents. Gasoline prices remain about a nickel lower than the highs seen following Hurricane Harvey last summer and are trading at $2.1230 this morning, down 1.1 cents.

Markets are eagerly anticipating the President’s announcement that will be coming out later this afternoon. Yesterday was a classic example of traders “selling the fact” – the fact being that a decision is coming. Prices soared during yesterday’s trading session, however the market shifted lower after Trump’s announcement, losing nearly all of Monday’s gains during afterhours trading.

Opinions about the impact of Iran sanctions on the oil market vary. Some analysts estimate that 1 million barrels per day of oil could be taken off the global market, while others estimate levels as low as 200,000 barrels per day. If the U.S. is the only country to reject the Iran agreement, the impact could be minimal. However, if other importers such as the EU, China, India or South Korea join America in their cut of Iranian oil imports, global supply could tighten. Expect volatile trade during the last 30 minutes of today’s trading session following the 2 o’clock announcement.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.