Iran Nuclear “Proof” Fizzles Out

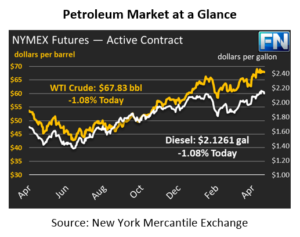

After beginning the day lower, markets encountered a surge in buying action leading up to Israeli President Netanyahu’s speech on Iran. In another classic “buy the rumor, sell the news” event, markets are trending lower this morning following the speech. Crude prices are currently $67.83, down 74 cents (-1.1%) since yesterday’s close.

Fuel prices are also on the downward trek, in sympathy with lower oil prices. Diesel prices hit a new three-year record high yesterday, while gasoline prices hit their highest level since Hurricane Harvey. Diesel prices this morning are trading at $2.1261, a loss of 2.3 cents (-1.1%). Gasoline prices are $2.1060, down 2.5 cents (-1.2%).

Markets anticipated new proof from the Israeli leader that Iran has a nuclear weapons program and is a threat to regional stability. Market enthusiasm helped propel prices to positive territory. However, the general perception by markets was that Netanyahu failed to meet expectations – his “proof” was the same information markets have known about since 2015 when the Iran deal was first signed. This all comes against a backdrop of Trump threatening to lift the waiver on sanctions on May 12, unraveling the Iran nuclear deal. Sanctions would take up to a million barrels per day of oil off the market, causing prices to soar higher.

Markets are also falling this morning thanks to a stronger US dollar. The Federal Reserve is meeting to discuss interest rates. Although no change in interest rates is expected this time, the buzz of news and activity surrounding the event has been enough to keep oil traders conservative this morning. Markets are expecting the Fed to suggest the economy remains strong and further tightening is appropriate, clearing the way for a June interest rate hike.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.