Art of the Deal or Risky Business?

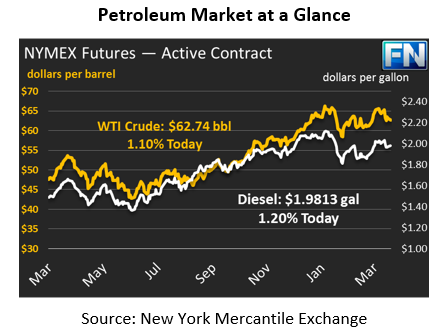

Markets remain range bound in the $61-$66 price range, with prices on Friday sinking lower due to ongoing concerns over U.S.-China trade relations. Crude prices this morning are up slightly relative to Friday’s close, with prices at $62.74, a gain of 68 cents.

Fuel prices are also trading a bit higher after their Friday losses. Diesel prices have nearly recovered their losses from Friday, trading up 2.35 cents at $1.9813. Gasoline prices are rising more slowly, but are still trading 1.09 cents higher with a price of $1.9656.

China Shakes Confidence

While markets are coming to realize that Trump is just acting out his book, The Art of the Deal, they also lack confidence in the negotiation techniques of making bold claims to gain leverage. China is a major international power, seeking to protect their own dignity and economic interests, so they may be less responsive than Trump is used to in the boardroom. Trump’s actions are not necessarily irrational, but he’s certainly playing a risky game.

Crude prices have been suffering in response to the disputes. On Friday, Trump threatened to add tariffs on another $100 billion of Chinese products. Markets are reacting for two reasons – first, the tariffs threaten the financial performance of the two biggest economies in the world. A drop-off in demand would cause market fundamentals to shift towards oversupply, causing prices to fall lower. Second, markets fear the tariffs could be extended to cover oil exports from the U.S. to China, which could cause a severe disruption to markets. U.S. crude oil would be stranded in the U.S., flooding domestic markets with excess crude.

Has the market forgotten about all the geopolitical risk we talked about just a few short weeks ago? The appointments of John Bolton and Mike Pompeo sent prices soaring up to $65, yet now prices are feeling more bearish again. Part of the issue is that markets are fickle – they move based on headlines rather than facts. The news of hawkish military leaders was bullish, but no war began in the last few weeks. At the same time, no new tariffs have actually be signed other than the steel and aluminum tariffs mentioned weeks ago. It takes months to impose new tariffs. So while all of these headlines point to possible future changes, they have had no true impact on market fundamentals (yet). True changes in sentiment generally occur when markets fundamentally change – OPEC physically cuts production, oil demand metrics fall. Right now, the fundamentals point to strong demand and low supply – which ought to keep prices supported for now. As you listen to market news, be sure to ask yourself whether the cause is based on market panic, or true supply and demand changes.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.