Today’s Market Trend

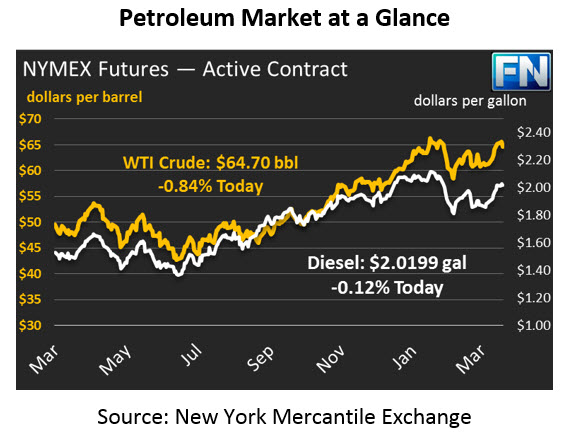

Crude oil weakened yesterday following a bearish API report. The Crown Prince of Saudi Arabia commented that OPEC is seeking supply cooperation with Russia and other non-OPEC countries for 10-20 years. The comments boosted prices mid-morning, but they could not hold their strength throughout the day. Prices traded down 30 cents overall to settle at $65.25, despite reaching a high of $66.41 following the OPEC chatter. Crude has continued its decline into the morning, losing another 55 cents (.84%) to fall below the $65/bbl mark, currently trading at $64.70.

The large build in crude oil and Cushing stocks kept downward pressure on oil prices, but fuel prices managed to stay in positive territory thanks to large gasoline and diesel draws reported by the API. Diesel rose half a penny on Tuesday but has retracted half of the gains this morning. Gasoline also inched higher yesterday gaining a mere 34 points. Today, diesel is down 25 points (.12%) and is currently trading at $2.0199. Gasoline is mostly flat but remaining in the black this morning, trading up 5 points (.02%) at $2.0140.

Yesterday’s API report showed mixed numbers for inventories but was overall bearish for prices. Crude posted a large build of 5.3MMbbls, contradicting the market’s expectation of a 0.3MMbbls draw. Both products posted draws, with gasoline drawing down by a large 5.8MMbbls. In addition to the build in crude inventories, API also reported an additional 1.7 MMbbls build in Cushing stocks, keeping prices flat to lower across the board. If the EIA confirms the build in crude inventories, prices could continue to move lower absent of geopolitical uncertainty.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.