“Golden Age” for Oil’s Seven Sisters

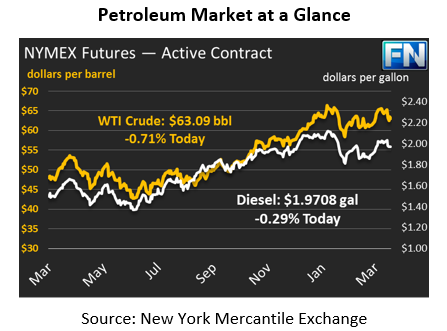

Markets traded mostly flat yesterday, giving up slight losses in the morning before remaining unchanged. Markets are lacking any particular news to drive prices in either direction, so focus today will be on the API’s inventory report this afternoon. Crude prices are holding around $65.53, virtually unchanged from yesterday’s close.

Fuel prices showed mixed results yesterday, though today both are in positive territory. It’s worth noting that for the first time since March 1, diesel prices closed at a higher price than gasoline prices. Diesel prices gave up just 1/3 of a cent yesterday, while gasoline prices fell a full 1.5 cents. Today, diesel prices remain stronger than gasoline prices. Diesel prices are $2.0265 this morning, a gain of 1.2 cents (0.6%). Gasoline prices have only picked up 0.5 cents, trading at $2.0149.

After some early morning losses yesterday, markets halted their decline following news that Saudi Arabia intercepted numerous missiles launched from Yemen yesterday. While unlikely to escalate, the event does reflect the ongoing instability in the Middle East. Given new hawkish foreign policy leaders in the U.S., markets are growing worried that the U.S. will not adequately manage instability – or worse, that we’ll add further uncertainty to already unstable environments.

Yesterday, Goldman Sachs noted that Oil’s Seven Sisters, made up of the largest oil companies in the world, are entering a “golden age” environment of favorable returns. After several years of small or negative earnings, the top oil companies are expected to create good returns for investors, thanks to rising crude prices and lowered drilling costs. A dearth of oil projects commissioned in 2011-2013, and put on hold during the collapse of oil prices, are now coming online rapidly, bringing new revenue streams to companies large enough to withstand crude’s slump.

China remains a significant conversation point for markets. Trade talks are continuing between U.S. Treasury Secretary Mnuchin and China’s trade leadership. China accounted for over 20% of crude exports in Q4 2017 – if anti-trade sentiment escalates and reaches oil markets, it could force U.S. producers to find a new home for 350 kbpd of crude oil, likely filling inventories and driving prices lower.

One big question for WTI oil prices (and therefore, U.S. fuel prices) is inventories in Cushing, Oklahoma. Inventories have been declining ever since the Keystone Pipeline leaked late in 2017, reducing Canadian supplies into Cushing stocks. For the last two weeks, inventories managed to eke minor gains, creating more room for oil prices to fall. If Cushing inventories resume their declines this week, expect crude prices to remain elevated; if inventories rise, the market may turn towards lower prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.