US-Saudi Meeting Triggers Rally

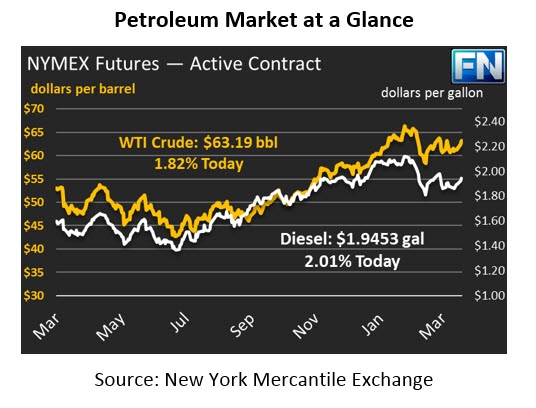

Oil prices stayed relatively flat yesterday (perhaps still recovering from St. Patrick’s Day?), keeping losses below half a percent. Today, the market is soaring, gaining over $1 this morning in early trading. Crude prices are currently up $1.13 (1.8%) above yesterday’s closing price, trading at $63.19.

Fuel markets were also generally quiet, though gasoline did lose 2 cents for a 1.1% loss. Today, however, both markets are joining crude oil and rising higher. Diesel prices are currently at $1.9453, picking up 3.8 cents (2.0%). Gasoline prices are keeping pace with crude oil but lagging diesel prices, trading at $1.9604, a gain of 3.5 cents (1.8%).

Saudi-US Meeting Prompts Oil Rally

With Saudi Arabia’s crown prince visiting President Trump today, markets are anticipating some hawkish rhetoric regarding Iran in the coming days. Saudi’s foreign minister and the Trump administration agree that the Iran deal needs to be revised, and Trump has established his willingness to withdraw from the deal if changes are not made. Over the weekend, some European allies have also agreed to strong sanctions on Iran if the U.S. remains in the deal.

All signs point towards tighter controls put on Iran, and oil markets are concerned sanctions could include oil. When the Iran deal passed and Iranian oil came to the international market, prices plummeted several dollars lower. Taking even a portion of Iranian supply off the market could cause the same reaction in reverse.

Where Are the Equities?

The stock market fell yesterday, yet oil prices held roughly steady. Today, oil prices are soaring despite just mild gains for the DJIA. Given the correlation between the two markets in recent weeks, why is there a disconnect?

Contrary to some analysis, the alignment between equity markets and commodities has not been a direct relationship. Rather, a deeper root cause (name, interest rates) has been affecting both markets the same way. The stock market’s recent movements have been due to tech stock performance, not any fundamental change in expected interest rates that might impact both markets. That’s why the two markets have appeared unlinked for the past couple days.

Of course, it only takes a few sentences from the Fed to reignite the relationship between the two markets. Changes in the equities markets don’t always cause a spillover into oil markets, but changes in interest rates will nearly always have a profound impact on both stocks and commodities.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.