Absent Fundamental News, Oil Follows Politics

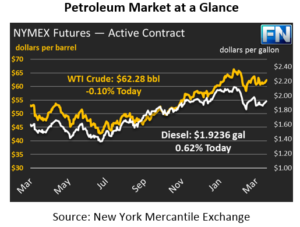

Markets rose inexplicably on Friday, gaining over $1/bbl in the morning despite no major headlines or announcements to justify the increase. The change was not unusual – when markets trend in a sideway manner, they occasionally jump up or down to test different support levels. Friday’s closing price of $62.24 was the highest closing price since March 6. Today, crude prices remain relatively flat, trending slightly lower this morning. WTI crude prices are $62.28 currently, basically flat from Friday’s closing price.

On the fuels side, prices received a boost as well, though less enthusiastic. While crude prices gained 1.9% on Friday, gasoline prices gained 1.1%, while diesel prices rose just 1.0%. Today, both prices remain in positive territory, though narrowly. Diesel prices are currently up by a penny (0.6%), trading at $1.9236. Gasoline prices are up just 0.3 cents, trading at $1.9490.

Internationally, there hasn’t been any fundamental changes for oil markets, but there have been numerous major political announcements tangentially affecting oil markets. This weekend, Vladimir Putin was officially re-elected as President of Russia, winning in a landslide victory. His victory was not a surprise, but will help keep prices elevated for two reasons. First, Putin supports the OPEC/Non-OPEC production cuts, so his continued presence bodes well for continued extensions of the deal. Second, his adversarial relationship with the West generates on-going volatility vis-à-vis countries within its sphere of influence.

In addition to Putin’s re-election, Saudi Arabia’s Crown Prince Mohammed bi Salman was interviewed on 60 Minutes this weekend. Though generally in line with expectations, the prince noted that Saudi Arabia would look to acquire a nuclear weapon if Iran assembled one – certainly not a stabilizing comment for global markets. At the same time, he reaffirmed his commitment to the public offering of Saudi Aramco, the massive Saudi oil company valued at roughly $2 trillion. While markets speculate about the timing of the offering, it appears that Saudi officials remain committed to the concept. The company’s value increases when crude oil prices rise, so Saudi Arabia has a strong incentive to boost oil prices leading up to the public offering.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.