Natural Gas News – March 12, 2018

Natural Gas News – March 12, 2018

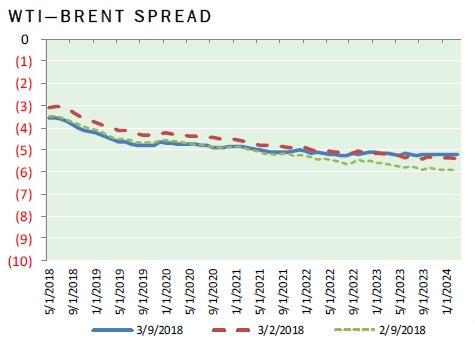

3 Natural Gas Charts to End Winter 2018

Forbes reported: Burdened by a historically low-price environment for oil since 2014 and gas since 2008, it’s amazing how quickly the efficiency of our industry has evolved. U.S. oil and gas drillers have upgraded their operations and technologies far faster than anybody could have predicted and are now producing at record highs. As it turns out, the long perception that U.S. crude oil production peaked in 1970 was wrong, as was the perception that U.S. gas production peaked in 2005. Those companies that couldn’t improve were forced out of the industry, with 100+ combined bankruptcies in 2015 and 2016. As reported by BNEF’s 2018 Sustainable Energy Factbook, which is a must read every year, the incredible declines in breakeven costs for the U.S. natural gas industry illustrate a fact that hardly ever gets mentioned. Renewable energy technologies won’t simply be handed the future: renewables won’t be competing against oil and gas as they are now but as they will become. The renewable industry is evolving but so is the oil and gas industry. The high gas prices that we saw before the shale revolution aren’t really possible anymore. For more on this story visit forbes.com or click http://bit.ly/2p8kh9i

Natural Gas Prices Continue to Slip

Nasdaq reported: Energy stocks are poised for a markedly higher opening as broader index futures continued yesterday’s gains after the government reported better-than-expected job growth for the previous month. Oil prices are reversing two days of heavy losses even as the greenback jumped following a much stronger than expected jobs report and on hopes of a breakthrough in the nuclear standoff with North Korea. North Korea’s leader pledged to refrain from further nuclear or missile tests, lifting Asian stock markets and pulling crude oil futures along with them. For more on this story visit nasdaq.com or click http://bit.ly/2tvYYnx

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.