This Week in Review

Markets continued the swing higher this week following the correction earlier in February. The last week of January brought a large 6.8 MMbbl crude stock build, causing markets to shudder. February so far has brought only a mild build – two weeks ago, inventories rose 1.8 MMbbls, and yesterday stocks reportedly fell 1.6 MMbbls. The steady inventories we’ve seen over the last two months is counter-seasonal, likely attributable to on-going production cuts by OPEC.

Like last week, inventory reports were the major turning point of the week. Prices fell throughout the week, but turned around when the EIA reported a net crude stock build. Continued draws at Cushing, OK, the delivery point for WTI crude, contributed to the decline as well. Crude oil exports above 2 MMbpd helped to keep stocks low, though crude production above 10.2 MMbpd kept upward pressure on stocks. The fact that crude inventories fell in the midst of refinery maintenance season is astounding, given that refinery inputs fell 320 kbpd this week.

Crude prices began the week after a lazy three-day weekend, taking Presidents Day off on Monday. Starting the week Tuesday at $61.63, prices reached a low point of $60.75 on Thursday before rebounding, reaching a high above $63. Prices opened Friday at $62.60, a gain of a dollar (1.6%) for the week.

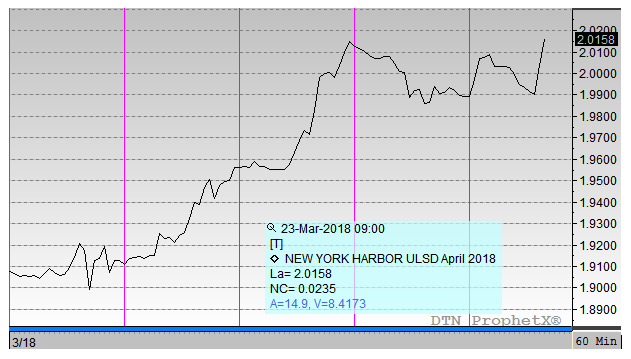

Diesel prices appear more dynamic, but actually have mostly tracked crude prices on a percentage basis. Diesel prices opened the week above $1.91, falling in line with diesel prices. A larger 2.4 MMbbl draw from diesel stocks gave prices a boost on Thursday, rising from a low of $1.916 to a high of $1.958. Today, prices opened at $1.9461, lower than yesterday’s high, but still showing a gain of 3.2 cents (1.7%).

Gasoline prices sputtered a bit, with an inventory build this week putting a damper on prices. High production levels have outpaced strong exports, leading to continued builds while winter gasoline demand remains moderate. Gasoline began the week at $1.7489, and each day has only managed to post moderate gains. Today’s opening price of $1.7661 represents a mere 1.7 cents (1.0%) gain.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.