Natural Gas News – February 12, 2018

Natural Gas News – February 12, 2018

US’ Largest Natural Gas Exporter Announces Huge Deal with China

Washington Examiner reported: The largest natural gas exporter in the U.S. announced two major deals with China on Friday to sell U.S. natural gas through the 2040s. Cheniere Energy agreed to supply China’s state-owned energy company with 1.2 million tons of liquefied natural gas, or LNG, per year. The long-term supply and purchase agreements were built on a Memorandum of Understanding the company signed with China’s energy authority in November. Cheniere will begin shipping a portion of the fuel from its LNG export facility at Sabine Pass, La., later this year. The rest of the fuel will be made from its second facility being built in Corpus Christi, Texas, beginning in 2023. The supply and purchase agreements extend through 2043. The company is in the middle of completing its Corpus Christi facility, which now will include a third natural gas export station as an addition to its original design. Once all production facilities are up and running, the company will be one of the top five exporters of LNG in the world. The company began shipping fuel to China from Sabine Pass in 2017 with a single shipment. But China is looking to boost its imports of energy to support its plan to phase out its coal power plants in favor of cleaner-burning natural gas. Each export station is able to serve one LNG shipping vessel.

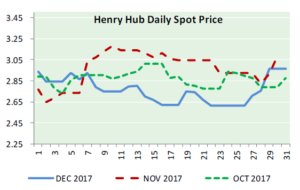

Natural Gas Price Fundamental Daily Forecast – Downside Momentum Strong Enough to Challenge $2.532

FX Empire reported: Natural gas futures are trading sharply lower early Friday despite yesterday’s government report that showed a bigger-than -expected draw from storage the previous week. The market is now convincingly below the January 5 bottom at $2.693 with enough downside momentum to make the December 21 main bottom at $2.532 a valid target over the near-term.

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.