Today’s Market Trend

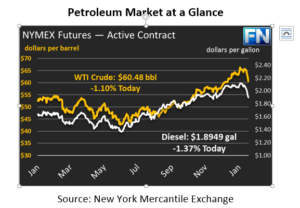

Oil markets continue to be affected by spillover stock market losses. Oil prices lost another 64 cents (1.0%) yesterday, continuing the race to lower prices. Today, crude prices are falling still lower, with prices currently down 67 cents (-1.1%) to $60.48.

Fuel prices saw much smaller losses yesterday, supported by lower refinery throughputs adding less new product to the market. Diesel prices fell a penny yesterday, while gasoline prices hardly moved at all. Today, both products are down by a large margin. Diesel prices are currently down 2.6 cents (-1.4%), trading at $1.8949. Gasoline prices are trading at $1.7451, a loss of 2.0 cents (-1.1%).

It will be interesting to see the CFTC data that comes out today. Oil markets have reached record high speculative length, as money managers bet on rising oil prices. Given the precipitous fall in prices that many have attributed to profit-taking, expect to see net length fall relative to last week.

There’s been little fundamental news moving the market. Most of the losses are related to an overall drop in financial markets. The Federal Reserve have promised higher interest rates once the economy improves, and current economic statistics point to robust growth. Higher interest rates impact oil prices in numerous ways:

- They make the dollar stronger relative to international rates, which incentivizes imports rather than exports and reduces prices.

- They reduce the amount of liquidity in the market, since higher interest rates make it harder to finance trading activity. While not a fundamental impact, less traders able to get financing means lower volumes and less trading activity, which can impact price volatility.

- They increase the return on bonds, which are a more stable investment than volatile oil prices or equities. As investors reduce their positions in oil markets, trading volumes decrease.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.