Today’s Market Trend

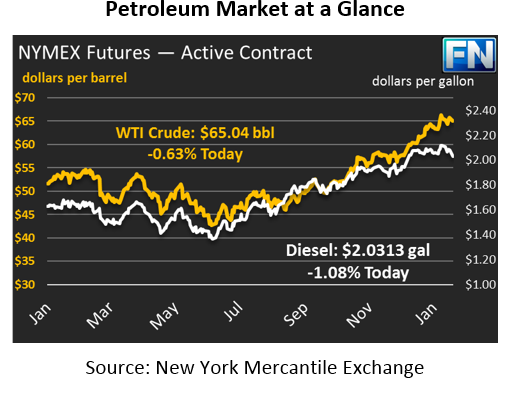

Oil markets are falling this morning, continuing Friday’s declines. Brent-WTI spreads are narrowing as Brent prices plummet relative to U.S. WTI prices – spreads fell as low as $2.80 this morning, the lowest point since August 2017. Crude prices this morning are currently $65.04, 41 cents (-0.6%) lower than Friday’s closing price.

Fuel prices are also trending lower. After a big price gain on Thursday, prices fell strongly on Friday. Diesel prices gave up more than four cents, while gasoline fell by nearly three cents. Both products are still dropping this morning. Diesel prices are currently trading at $2.0313, a loss of 2.2 cents (-1.1%). Gasoline prices are currently $1.8585, falling 1.4 cents (-0.7%) since yesterday’s close.

Secretary of State Rex Tillerson hinted at new oil sanctions on Venezuela, which could raise U.S. fuel prices if they become a reality. Although production has been plummeting in the South American country, December production was still 1.7 MMbpd. U.S. politicians are looking for ways to force Venezuelan President Maduro to make political reforms; oil sanctions may be one of the best tools in their arsenal to ensure those reforms take place. Crude oil is a global commodity, meaning sanctions will ultimately lead crude to be re-routed elsewhere; however, the short-term impact would be slightly higher prices for crude in the U.S.

Countering bullish threats of sanctions has been declining refinery throughputs. Several refineries in the Gulf Coast are undergoing planned maintenance, which is reducing demand for crude oil and helping to keep prices low. Last night, portions of the nation’s largest refinery – Motiva Port Arthur – were sent offline for planned maintenance, taking 300 kbpd of refining offline for the rest of the month. Similar maintenance shutdowns are taking place at a few other Texas refineries, and more are scheduled this month.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.